Welcome to this week’s market outlook for June 17, 2024. This report provides insights from global financial market strategists, covering key instruments, macroeconomic highlights, and technical analysis. Let’s dive into the latest developments and expectations for the week ahead.

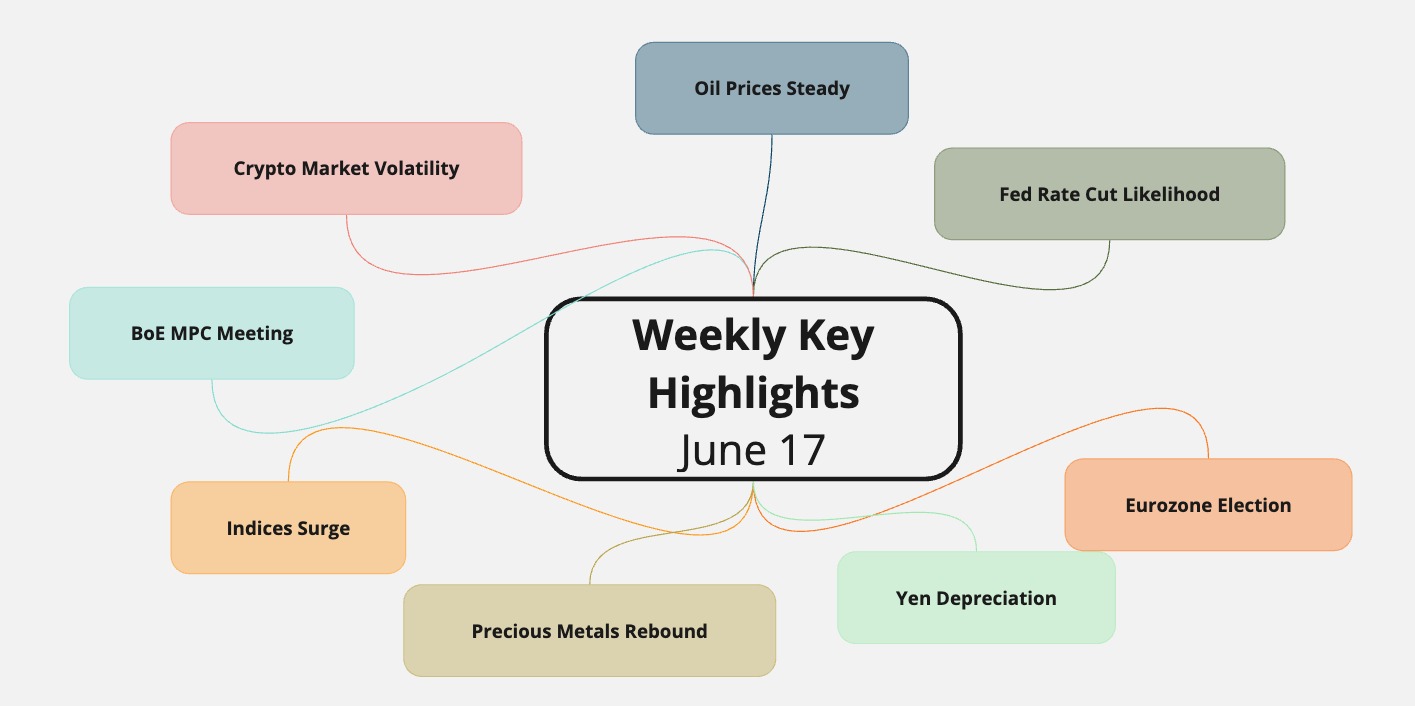

Key Highlights

1. Fed Rate Cut Likelihood

- Details: The likelihood of a Fed rate cut in September has increased, raising the possibility of two rate cuts this year. Recent economic data has shown signs of slowing growth, particularly in the manufacturing sector, and inflation remains below the Fed’s target. These factors contribute to increased speculation that the Federal Reserve will need to lower interest rates to support the economy.

- Impact: This potential rate cut scenario is expected to impact the US dollar and related financial instruments significantly. A rate cut typically leads to a weaker US dollar as it reduces the returns on investments denominated in dollars. Consequently, this could affect international trade balances, commodity prices, and foreign exchange markets. Investors might see increased volatility in US Treasury yields and a shift in investment strategies as market participants adjust to the new interest rate environment.

2. Eurozone Election

- Details: The Eurozone election result could stabilize policy to support the economy. The election outcomes are expected to influence the fiscal and monetary policy decisions in the region. A stable political environment is essential for implementing effective economic policies that can support growth and recovery, especially amid ongoing challenges such as high inflation and geopolitical tensions.

- Impact: The stabilization is crucial for economic support amidst ongoing market fluctuations. A stable Eurozone political landscape can bolster investor confidence, leading to increased capital inflows and higher investment in European markets. This stability can also enhance the effectiveness of the European Central Bank’s policies, promoting economic resilience and growth. Additionally, a positive election outcome can support the euro’s strength against other major currencies.

3. BoE MPC Meeting

- Details: The BoE MPC (Bank of England Monetary Policy Committee) meeting this week could keep the interest rate unchanged. The decision is influenced by recent economic indicators, including inflation rates, employment data, and GDP growth. Keeping the interest rate steady suggests that the BoE aims to maintain current economic stability while monitoring upcoming data before making any significant policy changes.

- Impact: This decision is pivotal for the UK financial market, impacting investor confidence. An unchanged interest rate provides a stable environment for businesses and consumers, supporting ongoing economic activities. It can also affect the value of the British pound, influencing international trade and investment flows. Market participants will closely watch the BoE’s forward guidance for hints on future rate adjustments.

4. Yen Depreciation

- Details: The Yen faces potential further depreciation with widening interest rate differential between Japan and other major economies. The Bank of Japan’s commitment to maintaining ultra-low interest rates contrasts with the tightening monetary policies of other central banks, leading to capital outflows from Japan and a weaker yen.

- Impact: This trend affects Japan’s economic stance and global trade dynamics. A weaker yen makes Japanese exports more competitive, potentially boosting Japan’s trade surplus. However, it also increases the cost of imports, leading to higher inflationary pressures. The depreciation can impact global supply chains and trade balances, influencing international business strategies and economic policies.

5. Precious Metals Rebound

- Details: Precious metals, particularly gold and silver, have rebounded on soft US economic data, which has raised expectations of a Fed rate cut. Lower interest rates generally increase the appeal of non-yielding assets like gold and silver as they reduce the opportunity cost of holding these metals.

- Impact: This rebound provides opportunities for investors in the commodities market. Higher demand for precious metals can lead to price increases, benefiting traders and investors who hold long positions. The rebound can also signal market sentiment shifts towards safer assets, reflecting broader economic uncertainties.

6. Oil Prices Steady

- Details: Russia’s commitment to maintaining production quotas has helped hold oil prices steady despite last week’s unexpected crude stockpile increase. This commitment ensures that the supply-side of the oil market remains controlled, preventing a sharp decline in prices.

- Impact: This commitment helps maintain stability in the global oil market. Stable oil prices are crucial for energy-dependent economies and industries, influencing production costs and inflation rates. Consistent prices also support planning and investment in the energy sector, providing a predictable environment for both producers and consumers.

7. Crypto Market Volatility

- Details: Drying supplies on exchanges are allowing for higher volatility in the future as the stablecoin balance remains high. The reduced supply of cryptocurrencies on exchanges can lead to significant price swings as buying or selling pressure increases.

- Impact: Increased volatility offers both risks and opportunities in the crypto market. Traders can capitalize on price swings for potential profits, but it also introduces higher risk, requiring careful risk management strategies. Investors may see increased short-term movements in cryptocurrency prices, affecting investment decisions and portfolio allocations.

8. Indices Surge

- Details: As inflation worries ease, indices continue to surge. Lower inflation expectations reduce the pressure on central banks to tighten monetary policy aggressively, which supports equity markets by maintaining lower borrowing costs and higher liquidity.

- Impact: Positive trends in indices reflect overall market optimism. Higher equity prices can boost investor confidence and wealth, encouraging further investments and consumer spending. This optimism can lead to a positive feedback loop, supporting economic growth and corporate profitability.

Instrument Outlooks

US Dollar Index (DXY)

- Last Week’s Movement: +0.5875 (+0.56%)

- Outlook: Neutral

- Analysis: The US dollar rebounded, suggesting the Fed might postpone its easing cycle this year. The dollar index currently closes above both EMAs and breaks its descending trendline. If it closes above 105.00, it may head towards 105.60. Otherwise, it may stay within the 104.00-105.00 range.

Gold (XAUUSD)

- Last Week’s Movement: +39.028 (+1.7%)

- Outlook: Bullish

- Analysis: Gold futures surged, marking their first weekly gain in four weeks. The price may retrace further to the 2360-2386 area if it exceeds its current support of 2325.

Euro – US Dollar (EURUSD)

- Last Week’s Movement: -0.00987 (-0.91%)

- Outlook: Bearish

- Analysis: EURUSD dipped, retested the 1.0700 support, and inched above it. If it extends its plunge below 1.0700, the price may retest the 1.0600 support.

UK Pound – US Dollar (GBPUSD)

- Last Week’s Movement: -0.00321 (-0.25%)

- Outlook: Bearish

- Analysis: GBPUSD retested the 1.2800 resistance and briefly traded above it. If it extends its decline and forms lower swings, the price may retest the 1.2600 support.

US Dollar – Japanese Yen (USDJPY)

- Last Week’s Movement: +0.641 (+0.41%)

- Outlook: Bullish

- Analysis: USDJPY moved sideways in the 156.50-158.00 area. If it sustains its uptrend within the ascending channel, the price may gain upward momentum toward 160.00.

Macroeconomic Highlights

North America

- FOMC Outcome: The FOMC held the rate as expected. The new dot plot shows only one cut this year with higher inflation forecasts for 2024-2025. The new economic projections suggest that the May core PCE would fall, increasing the likelihood of a September rate cut.

Europe (UK, EU, CH)

- BoE MPC Meeting: The BoE MPC meeting is expected to hold the rate unchanged due to a recent rebound in inflation. The market anticipates the first 0.25% cut in November. The UK May CPI is expected to slow to 2.0% YoY, providing more support for interest rate cuts next time.

Asia and Oceania (JP, CN, AU, NZ)

- Japan: Japan’s 1Q GDP annualized QoQ growth final estimates improved slightly from -2% to -1.8%. Despite negative growth, a gradual recovery is expected. The BoJ plans to significantly reduce Japanese Government Bond purchases in August to normalize monetary policy.

- China: China’s May inflation data raised concerns over weak domestic demand. Consumer prices rose a muted 0.3% YoY, while producer prices fell 1.4% YoY, extending a deflation streak.

Fundamental Information

Metals (Gold and other metals)

- Gold Prices: Gold prices rebounded last week due to softer US inflation data, pushing expectations of Fed rate cuts during the second half, mainly in September and December. However, the FOMC meeting on Wednesday revealed that Fed officials are taking a more patient approach to cutting interest rates.

Energies (Oil and other energies)

- Oil Prices: USOIL edged higher, driven by robust summer fuel demand expectations. The US Energy Information Administration (EIA) raised its 2024 global oil demand growth forecast to 1.1 mln bpd. Russia’s commitment to OPEC+ production quotas reassured markets of supply stability.

Cryptos (Bitcoin and other cryptos)

- Bitcoin: Despite a slight decrease in April, the crypto sector attracted significant investments in May. Outflows from spot bitcoin ETFs like GBTC have contributed to downward pressure on bitcoin. Large withdrawals from exchanges suggest a tightening supply that may lead to increased volatility.

Economic Calendar Highlights

Monday, June 17, 2024

- 2:00 CNY: Fixed Asset Investment (YoY) (May)

- 8:00 EUR: ECB’s Lane Speaks

- 12:30 USD: NY Empire State Manufacturing Index (Jun)

- 17:00 USD: FOMC Member Harker Speaks

Tuesday, June 18, 2024

- 4:30 AUD: RBA Interest Rate Decision (Jun)

- 9:00 EUR: German ZEW Economic Sentiment (Jun)

- 12:30 USD: Core Retail Sales (MoM) (May)

- 13:15 USD: Industrial Production (YoY) (May)

- 17:00 USD: 20-Year Bond Auction

Wednesday, June 19, 2024

- 6:00 GBP: CPI (MoM) (May)

- 7:30 CHF: SNB Monetary Policy Assessment

- 22:45 NZD: GDP (QoQ) (Q1)

Thursday, June 20, 2024

- 6:00 EUR: German PPI (MoM) (May)

- 11:00 GBP: BoE Interest Rate Decision (Jun)

- 12:30 USD: Building Permits (May)

- 12:30 USD: Initial Jobless Claims

Friday, June 21, 2024

- 6:00 GBP: Core Retail Sales (MoM) (May)

- 8:00 EUR: HCOB Eurozone Manufacturing PMI (Jun)

- 12:30 CAD: Core Retail Sales (MoM) (Apr)

- 14:00 USD: Existing Home Sales (MoM) (May)

- 17:00 USD: US Baker Hughes Oil Rig Count

Conclusion

This week’s market outlook for June 17, 2024, presents a mix of bullish, bearish, and neutral stances across different instruments. The macroeconomic environment remains pivotal, with significant events and data releases expected to drive market sentiment. Stay informed and consider the outlined strategies for navigating the markets effectively.

For more detailed information on how you can succeed in this market with our Algo, visit Topaz Global.

Resources