Introduction to AI in Forex Trading

Artificial Intelligence (AI) is revolutionizing numerous industries, and forex trading is no exception. In an era where technology continually pushes the boundaries of what’s possible, AI stands out as a game-changer for traders looking to gain a competitive edge. This transformative technology is reshaping how trades are executed, analyzed, and managed, providing traders with unprecedented levels of efficiency and accuracy.

AI’s influence in forex trading extends from automating routine tasks to offering sophisticated analytical insights that were once thought to be the realm of human intuition. As the global forex market operates around the clock, the need for swift decision-making and the ability to process vast amounts of data in real-time becomes paramount. This is where AI shines, providing traders with tools that not only streamline their workflow but also enhance their decision-making processes.

The significance of AI in modern forex trading cannot be overstated. It helps in identifying market patterns, predicting price movements, and executing trades with a precision that reduces human error and emotional bias. For fund managers and investors seeking to stay ahead in a highly competitive market, understanding and leveraging AI technologies is becoming increasingly essential.

In this article, we will delve into how AI is transforming the forex trading landscape. We will explore its applications, benefits, and potential risks, offering insights into how traders can harness the power of AI to achieve better trading outcomes. Whether you are a seasoned trader or new to the forex market, this comprehensive guide will equip you with the knowledge needed to navigate the evolving world of AI-driven trading.

Understanding AI in Forex Trading

Definition of AI and Machine Learning

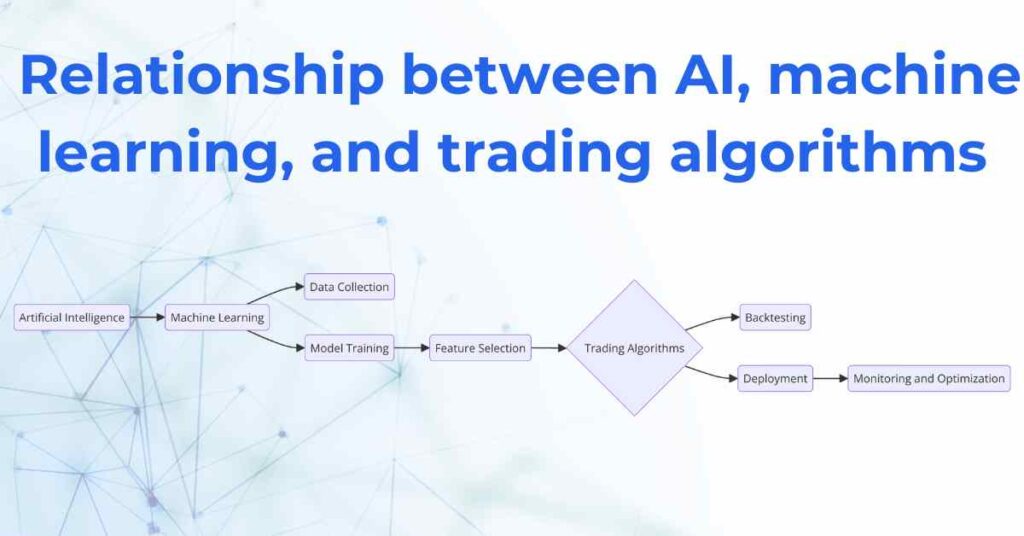

Artificial Intelligence, commonly referred to as AI, involves the development of computer systems that can perform tasks typically requiring human intelligence. These tasks include learning from experience, recognizing patterns, and making decisions. In the context of forex trading, AI encompasses a range of technologies, including machine learning, which allows systems to learn and improve from data without explicit programming.

Machine learning, a subset of AI, is particularly influential in trading. It involves algorithms that can process vast amounts of historical and real-time market data to identify trends and make predictions. These algorithms learn from past data and adjust their predictions as new data becomes available, enhancing their accuracy over time.

Historical Context

The use of AI in trading isn’t entirely new. It has evolved significantly over the past few decades. Initially, trading algorithms were rule-based systems designed to execute trades based on predefined criteria. However, with advancements in AI and machine learning, these systems have become more sophisticated, capable of adapting to changing market conditions without constant human intervention.

The transition from rule-based systems to machine learning algorithms has marked a significant milestone in the history of AI in trading. Today, these algorithms can analyze complex datasets, identify subtle market patterns, and execute trades at speeds far beyond human capability. This evolution has opened new possibilities for traders, enabling them to leverage AI’s power to optimize their trading strategies.

AI’s journey in forex trading reflects broader technological advancements, highlighting the continuous push towards more efficient and effective trading systems. As AI technologies continue to evolve, their impact on forex trading is expected to grow, offering even more sophisticated tools for traders to enhance their performance.

Applications of AI in Forex Trading

AI Trading Algorithms

AI trading algorithms are designed to analyze market data and execute trades based on pre-programmed criteria. These algorithms can process vast amounts of data at high speeds, identifying patterns and trends that may not be immediately apparent to human traders. By using machine learning techniques, these algorithms continually learn and improve from new data, enhancing their predictive accuracy over time.

For instance, AI algorithms can analyze historical price data, trading volumes, and other market indicators to forecast future price movements. This predictive capability allows traders to make more informed decisions and potentially achieve better trading outcomes. AI trading algorithms can also execute trades automatically, eliminating the need for constant monitoring and intervention by human traders.

Automated Trading Systems

Automated trading systems, also known as algorithmic trading or algo-trading, use AI to automate the trading process. These systems can execute trades at high speeds and frequencies, far exceeding human capabilities. By removing human emotions from trading decisions, automated trading systems can improve consistency and reduce the likelihood of errors caused by emotional reactions to market fluctuations.

Automated trading systems can be programmed to follow specific trading strategies, such as trend following, arbitrage, or market making. They can also incorporate risk management rules, such as stop-loss orders and position sizing, to protect against significant losses. This level of automation allows traders to execute complex strategies with precision and efficiency, even in fast-moving markets.

Predictive Analysis

One of the most powerful applications of AI in forex trading is predictive analysis. AI systems can analyze vast amounts of historical and real-time data to identify patterns and trends that may indicate future market movements. By leveraging machine learning algorithms, these systems can make predictions about currency price movements, market volatility, and other critical factors.

Predictive analysis can provide traders with valuable insights that inform their trading decisions. For example, an AI system might identify a pattern in the historical price data of a currency pair, suggesting that the price is likely to increase in the near future. Armed with this information, traders can make more informed decisions about when to enter or exit trades, potentially improving their overall trading performance.

Natural Language Processing (NLP)

Natural Language Processing (NLP) is another key application of AI in forex trading. NLP involves the use of AI to analyze and interpret human language, enabling systems to understand and respond to text and speech. In the context of forex trading, NLP can be used to analyze news articles, social media posts, and other textual data to gauge market sentiment and identify potential trading opportunities.

For example, an NLP system might analyze a large volume of news articles to determine the overall sentiment towards a particular currency. If the system detects a predominantly positive sentiment, it might predict that the currency’s price is likely to increase. Traders can use this information to make more informed decisions about their trades, potentially capitalizing on market trends before they become widely apparent.

Benefits of Using AI in Forex Trading

Increased Efficiency

AI significantly increases the efficiency of trading operations. Traditional trading methods often involve time-consuming tasks such as data collection, analysis, and decision-making. AI automates these processes, allowing traders to execute trades more quickly and accurately. This increased efficiency not only saves time but also enables traders to capitalize on market opportunities that require swift action.

For example, AI-powered systems can process and analyze large datasets in real-time, providing traders with up-to-date information on market conditions. This allows traders to respond to market changes immediately, reducing the lag between data analysis and trade execution. In a fast-paced market like forex, this speed and efficiency can make a substantial difference in trading outcomes.

Data Processing

One of the key strengths of AI is its ability to process vast amounts of data quickly and accurately. Forex trading involves analyzing multiple data sources, including historical price data, economic indicators, and market news. AI systems can handle these large datasets, identifying patterns and trends that might be missed by human traders.

By processing and analyzing data in real-time, AI systems provide traders with valuable insights that can inform their trading strategies. For instance, an AI system might analyze historical price data to identify a recurring pattern that suggests a potential price movement. Traders can use this information to make more informed decisions, potentially increasing their chances of success.

Reduced Emotional Bias

Emotional bias is a common challenge in trading. Human emotions such as fear and greed can influence trading decisions, often leading to suboptimal outcomes. AI eliminates this emotional bias, making decisions based solely on data and predefined criteria.

For example, an AI system might be programmed to execute trades based on specific market conditions, such as price movements or economic indicators. This ensures that trading decisions are consistent and objective, reducing the likelihood of errors caused by emotional reactions to market fluctuations. By removing emotional bias from the trading process, AI helps traders maintain discipline and stick to their strategies.

Enhanced Predictive Accuracy

AI’s ability to analyze large datasets and identify patterns enhances its predictive accuracy. Machine learning algorithms can learn from historical data, improving their predictions over time. This predictive capability is particularly valuable in forex trading, where accurate forecasts can significantly impact trading outcomes.

For instance, an AI system might analyze historical price data to predict future price movements. By identifying patterns and trends in the data, the system can make accurate predictions about where the market is headed. Traders can use these predictions to make more informed decisions, potentially increasing their chances of success.

24/7 Trading

The forex market operates 24/7, making it challenging for human traders to monitor the market continuously. AI systems, however, can operate around the clock, monitoring market conditions and executing trades at any time of day or night. This continuous operation ensures that traders can capitalize on market opportunities as they arise, even when they are not actively monitoring the market.

For example, an AI system might be programmed to execute trades based on specific market conditions, such as price movements or economic indicators. This ensures that trades are executed automatically, without the need for human intervention. By providing 24/7 trading capabilities, AI helps traders stay competitive in a fast-paced market.

How Traders Can Leverage AI for Better Outcomes

Choosing the Right AI Tools

Selecting the right AI tools is crucial for maximizing the benefits of AI in forex trading. Traders should look for tools that offer comprehensive features such as real-time data analysis, predictive modeling, and automated trading capabilities. It’s also important to choose tools that are user-friendly and compatible with existing trading platforms.

For instance, traders can use AI-powered trading platforms that provide customizable algorithms and advanced analytics. These platforms often come with built-in risk management features and the ability to backtest strategies using historical data. By choosing the right tools, traders can ensure they have the capabilities needed to enhance their trading performance.

Integrating AI with Trading Strategies

Integrating AI with existing trading strategies can significantly improve trading outcomes. Traders should start by identifying the key areas where AI can add value,

such as data analysis, trade execution, and risk management. By incorporating AI into their strategies, traders can leverage its predictive capabilities and automation features to make more informed decisions.

For example, a trader might use AI to analyze historical price data and identify trends that inform their trading strategy. They can then automate the execution of trades based on these trends, ensuring that trades are executed quickly and accurately. This integration allows traders to capitalize on market opportunities while maintaining control over their overall strategy.

Monitoring and Adjusting AI Systems

Once AI systems are in place, it’s important to continuously monitor their performance and make adjustments as needed. Traders should regularly review the accuracy of AI predictions, the effectiveness of automated trades, and the overall impact on their trading outcomes. By monitoring performance, traders can identify areas for improvement and ensure that AI systems are functioning as intended.

For instance, traders can use performance metrics such as win rates, average returns, and risk levels to evaluate the effectiveness of AI systems. If the AI system’s performance declines, traders can adjust the algorithms or parameters to improve accuracy. Continuous monitoring and adjustment help ensure that AI systems remain effective and aligned with trading goals.

Case Studies

Real-world case studies can provide valuable insights into how traders have successfully leveraged AI in forex trading. By examining these examples, traders can learn from the experiences of others and apply similar strategies to their own trading practices.

For example, a case study might highlight a trader who used AI to develop a predictive model for currency price movements. The trader could then automate trades based on the model’s predictions, resulting in improved trading performance. By studying these case studies, traders can gain practical knowledge and inspiration for integrating AI into their own trading strategies.

Potential Risks and Challenges of AI in Forex Trading

Over-Reliance on Technology

One of the significant risks associated with AI in forex trading is the potential for over-reliance on technology. While AI systems can provide valuable insights and automate trading processes, they are not infallible. Relying too heavily on AI without human oversight can lead to unforeseen issues, such as technical glitches or incorrect data interpretations.

For example, an AI system might misinterpret market data due to a software bug or an unexpected market condition. If traders rely solely on the AI system without monitoring its performance, they might incur significant losses. To mitigate this risk, traders should use AI as a tool to complement their strategies, not as a replacement for human judgment.

Data Quality Issues

AI systems rely on high-quality data to make accurate predictions and decisions. Poor-quality data can lead to incorrect analyses and suboptimal trading outcomes. Data quality issues can arise from various sources, such as incomplete data sets, outdated information, or errors in data collection.

For instance, if an AI system analyzes incomplete historical price data, it might make inaccurate predictions about future price movements. To ensure accurate results, traders should verify the quality of the data used by their AI systems and regularly update their data sources. By maintaining high data quality, traders can improve the reliability and accuracy of their AI systems.

Security Concerns

The use of AI in forex trading introduces new security concerns. AI systems often require access to sensitive information, such as trading strategies, market data, and personal financial details. If these systems are not adequately secured, they can become targets for cyberattacks.

For example, a hacker might attempt to gain access to an AI trading system to steal proprietary trading algorithms or manipulate market data. To protect against such threats, traders should implement robust security measures, such as encryption, multi-factor authentication, and regular security audits. By prioritizing security, traders can safeguard their AI systems and sensitive information.

Market Impact

The widespread use of AI in forex trading can have significant impacts on market dynamics. AI systems can execute trades at high speeds and volumes, potentially increasing market volatility. Additionally, if many traders use similar AI algorithms, it can lead to market distortions, such as artificial price movements or liquidity issues.

For example, if multiple AI systems simultaneously execute large buy orders based on the same market signal, it could cause a sudden spike in currency prices. To mitigate the potential market impact, traders should diversify their trading strategies and use AI systems that account for market conditions. By being mindful of the broader market effects, traders can use AI responsibly and minimize unintended consequences.

Future Trends of AI in Forex Trading

Advancements in AI Technology

The future of AI in forex trading looks promising, with continuous advancements in technology expected to further enhance its capabilities. Developments in machine learning algorithms, data processing techniques, and computational power will enable AI systems to provide even more accurate and timely insights. Traders can expect AI to become more sophisticated, offering advanced predictive analytics and more refined trading strategies.

For example, future AI systems might leverage deep learning techniques to analyze complex market patterns and make highly accurate predictions. These systems could also incorporate real-time data from a broader range of sources, such as social media and global news, to provide more comprehensive market analyses. As AI technology advances, traders will have access to more powerful tools that can help them navigate the forex market with greater precision.

Regulatory Developments

As AI becomes more prevalent in forex trading, regulatory bodies are likely to implement new rules and guidelines to ensure its responsible use. These regulations might focus on transparency, data privacy, and the ethical use of AI in trading. Traders and firms will need to stay informed about regulatory changes and ensure their AI systems comply with new standards.

For instance, regulatory bodies might require traders to disclose the use of AI in their trading strategies and ensure that AI systems are audited for fairness and accuracy. By staying compliant with regulations, traders can avoid legal issues and maintain the integrity of their trading practices. Regulatory developments will shape the future landscape of AI in forex trading, promoting its safe and ethical use.

Integration with Other Technologies

AI is expected to integrate with other emerging technologies, such as blockchain and quantum computing, to create more robust trading systems. Blockchain technology can enhance the security and transparency of AI-driven trading platforms, while quantum computing can significantly boost the processing power of AI algorithms.

For example, AI systems integrated with blockchain technology could provide tamper-proof records of trading activities, enhancing trust and security. Quantum computing, on the other hand, could enable AI systems to process and analyze vast amounts of data at unprecedented speeds, leading to even more accurate predictions. The integration of AI with these technologies will open new possibilities for traders, offering advanced tools for managing risk and optimizing trading performance.

Evolving Trading Strategies

As AI technology evolves, so will trading strategies. Traders will need to adapt to new tools and techniques, continuously updating their knowledge and skills to stay competitive. AI-driven trading strategies will become more dynamic, incorporating real-time data and adaptive algorithms that can respond to changing market conditions.

For example, future trading strategies might leverage AI to continuously monitor and adjust trading parameters based on real-time market data. This adaptive approach will allow traders to respond more effectively to market volatility and capitalize on emerging opportunities. By embracing evolving trading strategies, traders can harness the full potential of AI to achieve better trading outcomes.

Conclusion and Resources

Summary of Key Points

The role of AI in modern forex trading is profound, offering numerous benefits such as increased efficiency, enhanced predictive accuracy, and reduced emotional bias. AI trading algorithms, automated trading systems, predictive analysis, and natural language processing are just a few of the ways AI is transforming the trading landscape. While AI presents significant advantages, traders must also be mindful of potential risks, including over-reliance on technology, data quality issues, and security concerns.

As AI technology continues to evolve, its integration with other emerging technologies and the development of dynamic trading strategies will further enhance its impact on forex trading. Traders who stay informed about advancements and regulatory developments will be well-positioned to leverage AI effectively.

Final Thoughts

For fund managers and investors seeking to stay competitive in the fast-paced world of forex trading, understanding and leveraging AI is becoming increasingly essential. By embracing AI technologies and integrating them into their trading strategies, traders can improve their decision-making processes, capitalize on market opportunities, and achieve better trading outcomes.

Explore AI tools and technologies to enhance your forex trading strategies. Stay informed about the latest advancements and regulatory changes to ensure responsible and effective use of AI in your trading practices.

Resources and Further Reading

•Books and Articles

•“Artificial Intelligence in Finance: A Python-Based Guide” by Yves Hilpisch

•“Machine Learning for Asset Managers” by Marcos López de Prado

•“The AI Book: The Artificial Intelligence Handbook for Investors, Entrepreneurs, and FinTech Visionaries” by Ivana Bartoletti, Anne Leslie, and Shân M. Millie

•Websites and Tools

•Courses and Webinars

•Udacity’s “Artificial Intelligence for Trading” Nanodegree

By leveraging these resources, traders can deepen their understanding of AI in forex trading and stay ahead in a rapidly evolving market.