May 27th , Weekly Market Outlook

Summary

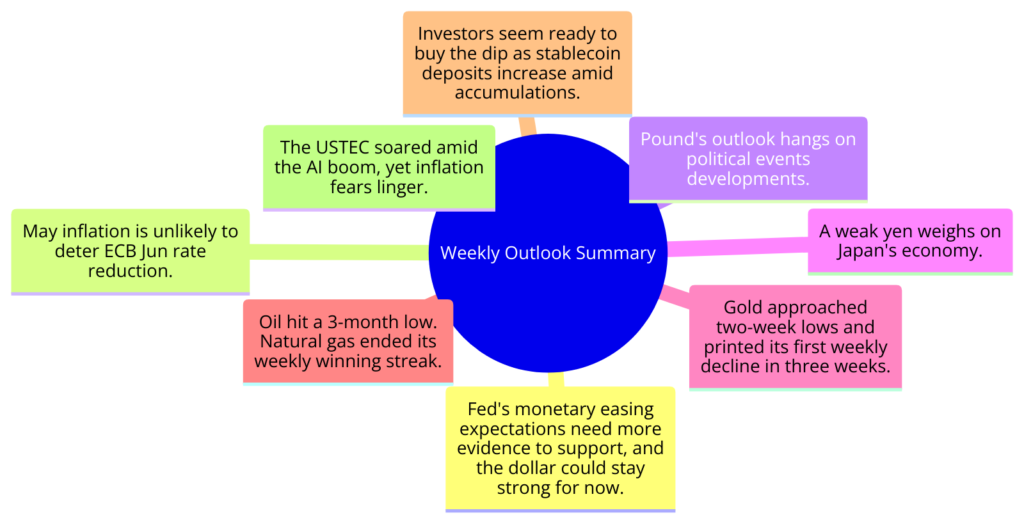

This week’s market outlook highlights key movements and trends that traders should be aware of. Despite the Fed discussing potential rate hikes, the overall economic data indicates a strong economy with jobless claims falling and business activities accelerating. However, uncertainties remain with mixed inflation data and geopolitical tensions affecting various markets. Here’s a closer look at the major points:

- Fed’s Monetary Easing Expectations: More evidence is needed to support expectations of monetary easing, keeping the dollar strong for now.

- ECB Rate Reduction: May inflation data is unlikely to deter the ECB from reducing rates in June.

- Pound’s Outlook: Political events in the UK are crucial for the pound’s future movements.

- Japan’s Economic Struggle: A weak yen continues to weigh on Japan’s economy.

- Gold and Oil Prices: Gold prices have approached two-week lows, experiencing the first weekly decline in three weeks. Oil prices hit a three-month low.

- Cryptocurrency Trends: Investors are showing readiness to buy the dip in cryptocurrencies as stablecoin deposits increase.

- Nasdaq 100: The USTEC soared amid the AI boom, yet inflation fears linger.

Global Analyst’s View

Based on our analysis, here are the market sentiments for various financial instruments this week:

- Bullish: Gold, Nasdaq 100, Bitcoin, Natural Gas

- Bearish: US Dollar Index, Crude Oil

- Neutral: Euro-Dollar, Pound-Dollar, Dollar-Yen

The combination of technical and macroeconomic analyses suggests these outlooks. Keep an eye on key economic indicators and geopolitical events that may influence these trends.

Macroeconomic Highlights

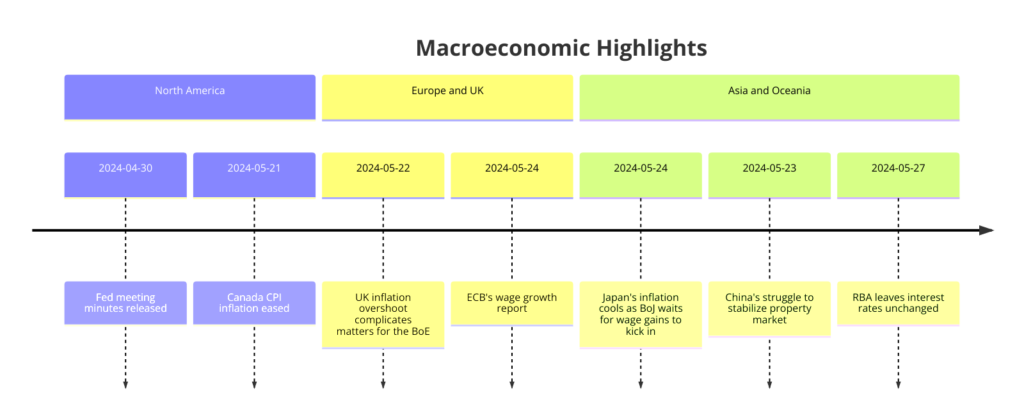

North America:

- US: The Federal Reserve’s discussions of potential rate hikes have been influenced by strong economic data, including falling jobless claims and accelerating business activities. However, the dollar could remain strong as the Fed requires more evidence for monetary easing.

- Canada: Inflation figures have slowed, with the headline CPI at 2.7% YoY in April, indicating a potential interest rate cut in the upcoming June meeting.

Europe (UK, EU, CH):

- Eurozone: Despite strong wage growth, the ECB is likely to proceed with a rate cut in June. However, the May inflation data will be crucial in determining further rate cuts.

- UK: Political developments overshadow major economic data. The pound’s outlook is heavily influenced by the early general election announced by Prime Minister Rishi Sunak.

Asia and Oceania (JP, CN, AU, NZ):

- Japan: The yen remains weak, impacting the economy. However, potential wage increases might boost consumption in the coming months.

- China: The real estate sector continues to struggle with falling housing prices and a significant unsold inventory. More substantial government intervention is needed to stabilize the market.

- Australia: The Reserve Bank of Australia’s minutes indicated a cautious approach to rate hikes, with future actions dependent on upcoming inflation reports.

Fundamental Information

Metals (Gold and Other Metals):

- Gold: Prices have weakened, approaching two-week lows. The strong dollar and rising yields have pressured gold, despite increased interest from money managers.

- Platinum: Prices surged due to supply concerns and strong demand.

Energies (Oil and Other Energies):

- Oil: Prices tested a three-month low due to increased US inventories and higher Russian production. The upcoming OPEC+ meeting may provide more direction.

- Natural Gas: Prices ended their four-week winning streak, with increased hedging activity indicating uncertainty in the market.

Indices:

- Nasdaq 100 and Hang Seng: Both indices showed strong trends, driven by earnings results and geopolitical developments.

- Dow Jones: Easing inflation pressures could benefit the index.

Cryptos (Bitcoin and Other Cryptos):

- Bitcoin: Significant ETF inflows and stablecoin liquidity indicate strong future demand. Regulatory developments also support a positive outlook.

Instrument Outlooks

Gold (XAUUSD):

- Technical: Bullish, with a new all-time high. Possible test of $2500 resistance.

- Macro: Boost from weaker dollar and central bank buying.

US Dollar Index (DXY):

- Technical: Bearish, potential test of 104.00 support.

- Macro: Mixed inflation data, Fed cautious on rate cuts.

Euro-Dollar (EURUSD):

- Technical: Bullish, possible move to 1.1025 resistance.

- Macro: Optimism on Eurozone recovery and slowing inflation.

Pound-Dollar (GBPUSD):

- Technical: Neutral, support at 1.2600, resistance at 1.2900.

- Macro: Positive UK GDP and potential rate cut by BoE.

Dollar-Yen (USDJPY):

- Technical: Neutral, support at 152.00, resistance at 158.50.

- Macro: BoJ cautious on policy changes, economic contraction.

Nasdaq 100 (USTEC):

- Technical: Bullish, support at 18300, resistance at 18800.

- Macro: Strong earnings, potential easing inflation boosts.

Crude Oil (USOIL):

- Technical: Bearish, resistance at 80.40.

- Macro: Rebounding on lower inventories, summer driving season.

Bitcoin (BTCUSD):

- Technical: Bullish, approaching resistance at 68800.

- Macro: Increased ETF inflows and stablecoin liquidity.

Natural Gas (XNGUSD):

- Technical: Bullish, potential rise to 2.85-3.00.

- Macro: Supply disruptions and geopolitical risks support prices.

This week’s market trends and outlooks provide valuable insights for traders. Stay updated with the latest economic data and geopolitical events to navigate the markets effectively. For more detailed information on how you can suceed in this market with our Algo, visit Topaz Global.