Table of Contents

Algorithmic trading, or algo trading, has revolutionized the financial markets, enabling traders and portfolio managers to execute trades with unprecedented speed and efficiency. This comprehensive guide covers everything from the basics of algorithmic trading to advanced strategies and real-world applications, providing a valuable resource for those looking to maximize returns through this cutting-edge approach.

What is Algorithmic Trading?

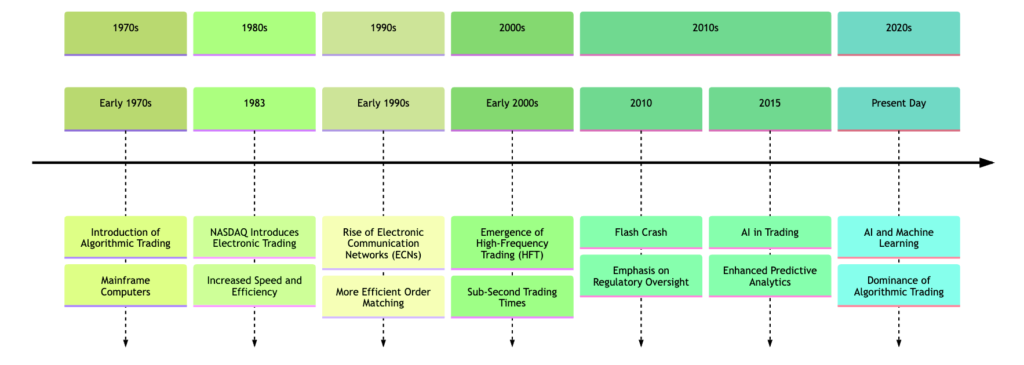

History and Evolution of Algorithmic Trading

Early Beginnings

Algorithmic trading, also known as algo trading, has its roots in the 1970s with the advent of electronic trading platforms. Before this period, trading was primarily conducted manually, with human traders placing orders via phone or in person on trading floors. The introduction of electronic trading systems revolutionized the way trades were executed, laying the foundation for the development of algorithmic trading.

- Introduction of Electronic Trading Platforms:

- The 1970s saw the emergence of the first electronic trading platforms, such as the NASDAQ, which provided a more efficient and transparent way to match buy and sell orders. These platforms enabled the automation of trade execution, reducing the need for manual intervention.

- Early algorithms were designed to automate the execution of large orders by breaking them down into smaller, more manageable chunks. This technique, known as “iceberging,” helped minimize the market impact and reduce transaction costs.

- Implementation of Simple Algorithms:

- Initial algorithms were relatively simple and focused on tasks like order execution and arbitrage. They were primarily used by large institutional investors to improve the efficiency of their trading operations.

- These early algorithms were rule-based, relying on pre-defined criteria to make trading decisions. For example, a basic algorithm might execute trades when a stock’s price reached a certain level or when a specified volume of shares was traded.

- Regulatory Changes:

- The deregulation of financial markets in the late 1970s and early 1980s, such as the removal of fixed brokerage commissions in the United States, further facilitated the adoption of electronic and algorithmic trading. These changes increased competition and incentivized the development of more efficient trading methods.

The Rise of High-Frequency Trading

The 1990s marked a significant turning point in the evolution of algorithmic trading with the rise of high-frequency trading (HFT). HFT firms began to leverage advancements in technology to execute a large number of trades at incredibly high speeds, transforming the landscape of financial markets.

- Technological Advancements:

- The proliferation of high-speed internet and advances in computer processing power enabled the development of complex algorithms capable of executing trades in milliseconds.

- Co-location services, where trading firms placed their servers in close proximity to exchange servers, further reduced latency and provided a competitive edge in speed.

- Development of Sophisticated Strategies:

- HFT firms employed sophisticated strategies that exploited short-term market inefficiencies. These strategies included statistical arbitrage, market making, and liquidity provision.

- Algorithms became more complex, incorporating advanced statistical models and machine learning techniques to identify and capitalize on fleeting opportunities.

- Impact on Market Dynamics:

- The rise of HFT significantly increased market liquidity and reduced bid-ask spreads, benefiting all market participants. However, it also introduced new risks, such as increased volatility and the potential for market manipulation.

- Regulatory bodies around the world began to scrutinize HFT practices, leading to the implementation of rules designed to curb excessive risk-taking and ensure market stability.

Modern-Day Algorithmic Trading

In the 21st century, algorithmic trading has evolved into a highly sophisticated practice that incorporates cutting-edge technologies such as machine learning, artificial intelligence (AI), and big data analytics.

- Integration of Machine Learning and AI:

- Modern algorithms use machine learning models to analyze vast amounts of historical and real-time data, identifying patterns and making predictions with a high degree of accuracy.

- AI techniques, such as natural language processing (NLP), enable algorithms to analyze unstructured data sources like news articles, social media posts, and earnings reports to gauge market sentiment and inform trading decisions.

- Big Data Analytics:

- The advent of big data has transformed algorithmic trading, allowing algorithms to process and analyze large datasets in real-time. This capability enhances the accuracy of predictions and the effectiveness of trading strategies.

- Algorithms can now incorporate a wide range of data sources, including economic indicators, financial statements, and alternative data like satellite imagery and social media trends.

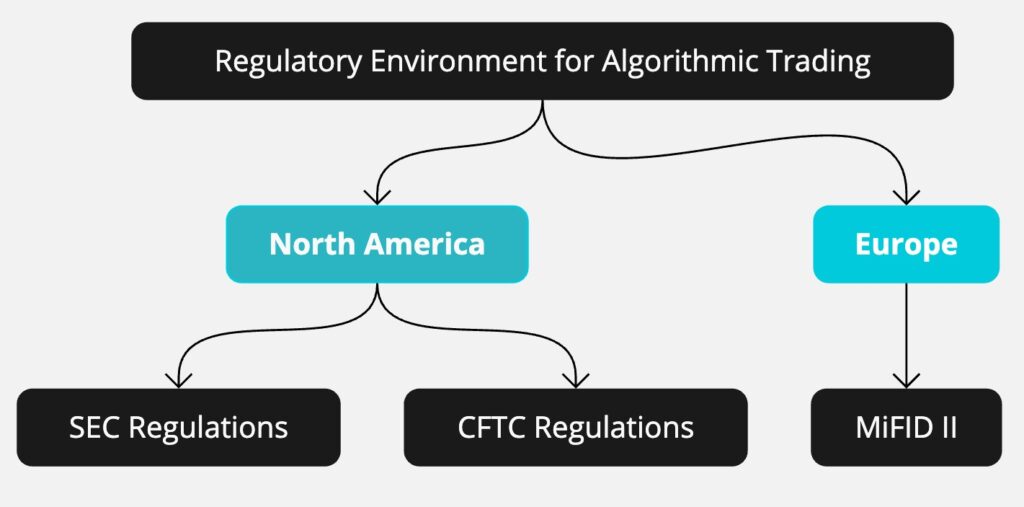

- Regulatory Environment:

- The regulatory landscape for algorithmic trading continues to evolve, with authorities implementing measures to address the risks associated with high-speed trading. These measures include requirements for greater transparency, risk management protocols, and safeguards against market manipulation.

- Despite the regulatory challenges, algorithmic trading remains a vital component of modern financial markets, contributing to improved market efficiency and liquidity.

- Widespread Adoption:

- Today, algorithmic trading is not limited to institutional investors. Retail traders also have access to algorithmic trading tools and platforms, democratizing access to advanced trading strategies.

- The growth of algorithmic trading has led to the development of a vibrant ecosystem of technology providers, data vendors, and research firms dedicated to supporting and enhancing algorithmic trading practices.

Key Developments in Algorithmic Trading

- Flash Crash of 2010:

- On May 6, 2010, the U.S. stock market experienced a sudden and severe crash, known as the Flash Crash, during which major indices dropped by about 9% within minutes before recovering. Algorithmic trading was implicated in exacerbating the crash, leading to increased regulatory scrutiny and the implementation of measures to prevent similar events.

- Implementation of MiFID II:

- The Markets in Financial Instruments Directive II (MiFID II), implemented in the European Union in 2018, introduced stringent regulations for algorithmic trading. These regulations aimed to enhance market transparency, reduce systemic risk, and protect investors by requiring detailed reporting and the use of circuit breakers to prevent market disruptions.

- Advancements in Quantum Computing:

- While still in its early stages, quantum computing holds the potential to revolutionize algorithmic trading by solving complex optimization problems much faster than classical computers. Research and development in this field are ongoing, with the financial industry closely monitoring its progress.

Future Directions

The future of algorithmic trading will likely be shaped by continued advancements in technology and evolving market dynamics. Key areas of development include:

- Enhanced AI and Machine Learning Models:

- Ongoing improvements in AI and machine learning algorithms will enable even more accurate predictions and sophisticated trading strategies.

- Increased Use of Alternative Data:

- The integration of alternative data sources, such as geospatial data and social media analytics, will provide new insights and competitive advantages in trading.

- Regulatory Evolution:

- As algorithmic trading continues to evolve, regulators will need to adapt and implement frameworks that balance innovation with market stability and investor protection.

Algorithmic trading has come a long way since its inception in the 1970s. From simple rule-based algorithms to sophisticated AI-driven strategies, it has transformed the financial markets, offering unparalleled speed, efficiency, and accuracy. As technology continues to advance, the role of algorithmic trading in shaping the future of financial markets is set to grow even further.

Key Components of Algorithmic Trading

Trading Algorithms

Trading algorithms are the backbone of algorithmic trading systems. They consist of a set of rules and mathematical models that ditate trading decisions based on market data analysis. These algorithms are designed to identify patterns and execute trades according to predefined criteria, eliminating the need for human intervention in the decision-making process.

- Types of Trading Algorithms:

- Trend-Following Algorithms: These algorithms aim to capture gains by following the direction of the market trend. They often use moving averages and momentum indicators to identify trends.

- Mean Reversion Algorithms: Based on the assumption that asset prices will revert to their historical averages, these algorithms buy assets when prices are low and sell when prices

are high. - Arbitrage Algorithms: These algorithms exploit price discrepancies between different markets or instruments to generate risk-free profits.

- Market Making Algorithms: Designed to provide liquidity to the market, these algorithms place both buy and sell orders to profit from the bid-ask spread.

- Development and Implementation:

- Strategy Formulation: The first step in developing a trading algorithm is formulating a trading strategy. This involves defining the rules and criteria for identifying trading opportunities.

- Backtesting: Once a strategy is formulated, it is backtested on historical data to evaluate its performance and identify any potential issues.

- Optimization: Parameters of the algorithm are optimized to enhance its performance. This may include adjusting the look-back period for indicators or fine-tuning entry and exit criteria.

- Implementation: The optimized algorithm is then implemented using a programming language such as Python, R, or C++.

- Example of a Trading Algorithm:

- A simple moving average crossover strategy involves buying a stock when its short-term moving average (e.g., 50-day) crosses above its long-term moving average (e.g., 200-day) and selling when the short-term average crosses below the long-term average. This strategy aims to capture trends in the market while avoiding noise.

Execution Systems

Execution systems are platforms or software applications that facilitate the actual execution of trades. They are critical for ensuring that trades are carried out efficiently and accurately, connecting trading algorithms to exchanges and trading venues.

- Components of Execution Systems:

- Order Management System (OMS): An OMS handles the creation, modification, and management of trade orders. It ensures that orders are sent to the appropriate trading venues for execution.

- Execution Management System (EMS): An EMS focuses on the actual execution of trades, including routing orders to different exchanges and managing trade confirmations.

- Risk Management: Execution systems often include risk management tools to monitor and manage trading risks in real-time.

- Types of Execution Systems:

- Direct Market Access (DMA): DMA systems allow traders to place orders directly on exchanges without intermediary intervention, providing faster execution speeds and lower latency.

- Smart Order Routing (SOR): SOR systems intelligently route orders to various trading venues to achieve the best execution price.

- Example of an Execution Protocol:

- The Financial Information Exchange (FIX) protocol is widely used for real-time electronic trading. FIX can handle high volumes of messages between trading systems, ensuring that orders are executed efficiently and accurately.

Data Feeds

Data feeds provide the real-time market data necessary for algorithmic trading. They include information such as prices, volumes, and other relevant metrics that are crucial for the accuracy and effectiveness of trading algorithms.

- Types of Data Feeds:

- Market Data Feeds: These provide real-time information on asset prices, trade volumes, and market depth.

- News Feeds: News feeds offer updates on economic events, corporate announcements, and other market-moving news.

- Alternative Data Feeds: These include non-traditional data sources such as social media sentiment, satellite imagery, and web traffic data.

- Importance of High-Quality Data:

- Accuracy: Accurate data is essential for making informed trading decisions. Any discrepancies in data can lead to incorrect trading signals and potential losses.

- Timeliness: Real-time data ensures that trading algorithms can react swiftly to market changes, capturing opportunities as they arise.

- Comprehensiveness: Comprehensive data feeds that include a wide range of information provide a more holistic view of the market, enabling better decision-making.

- Examples of Data Feed Providers:

- Bloomberg and Reuters are renowned providers of comprehensive data feeds. They offer real-time prices, news, and other financial information essential for algorithmic trading. These data feeds are integrated into trading platforms and used by institutional and retail traders alike.

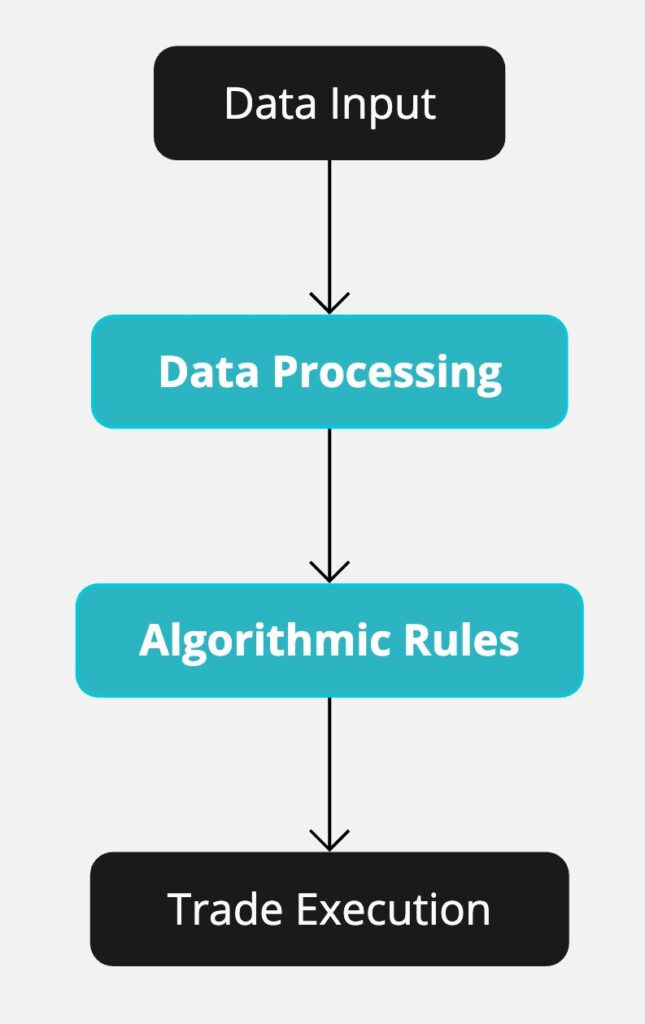

Integration of Key Components

The effectiveness of an algorithmic trading system depends on the seamless integration of its key components: trading algorithms, execution systems, and data feeds.

- Data-Driven Decision Making:

- Trading algorithms rely on high-quality data feeds to analyze market conditions and generate trading signals. Real-time data is fed into the algorithms, enabling them to make timely and accurate decisions.

- Efficient Trade Execution:

- Once a trading signal is generated, execution systems ensure that orders are placed and executed efficiently. These systems handle the complexities of order routing, trade matching, and risk management, allowing algorithms to focus on strategy execution.

- Continuous Monitoring and Feedback:

- A robust algorithmic trading system includes mechanisms for continuous monitoring and feedback. This ensures that the performance of trading algorithms and execution systems is constantly evaluated and optimized based on real-time market conditions.

Future Directions

The key components of algorithmic trading are continually evolving with advancements in technology and changes in market dynamics.

- Artificial Intelligence and Machine Learning:

- The integration of AI and machine learning into trading algorithms is enhancing their ability to analyze complex data sets, recognize patterns, and make predictive decisions with higher accuracy.

- Blockchain and Distributed Ledger Technology:

- The use of blockchain technology is improving the transparency and security of trading systems. Smart contracts and decentralized exchanges are providing new avenues for secure and efficient trade execution.

- Big Data and Alternative Data Sources:

- The incorporation of big data analytics and alternative data sources is providing trading algorithms with richer and more diverse information, leading to more informed and effective trading strategies.

By understanding and leveraging the key components of algorithmic trading, traders can build robust systems that enhance their trading performance and capitalize on opportunities in the financial markets. The continuous development and integration of these components will shape the future of algorithmic trading, driving further innovation and efficiency in the industry.

Importance of Algorithmic Trading

Why is it so Important?

Speed and Efficiency

Algorithmic trading enables the execution of trades at speeds and volumes that would be impossible for human traders. This speed can be a significant advantage, particularly in high-frequency trading (HFT).

- High-Speed Execution:

- Algorithms can execute trades within milliseconds, capturing fleeting market opportunities that human traders would miss due to reaction time limitations.

- The use of advanced computing power and high-speed internet connections ensures that trades are executed at the fastest possible speeds, maximizing the potential for profit.

- Volume and Scalability:

- Algorithms can handle and process large volumes of trades simultaneously, providing scalability that manual trading cannot match.

- This capability is particularly beneficial for institutional investors and hedge funds that need to execute large orders without affecting market prices.

- Example:

- In HFT, algorithms can execute thousands of trades per second, capturing small price discrepancies across different markets. This high speed can result in substantial cumulative profits over time.

Reducing Human Error

By automating trading decisions, algorithmic trading reduces the likelihood of human error, which can be caused by emotional decisions or miscalculations.

- Elimination of Emotional Bias:

- Human traders are susceptible to emotional biases such as fear and greed, which can lead to impulsive and irrational trading decisions.

- Algorithms follow predefined rules and criteria, ensuring that trading decisions are consistent and objective.

- Precision and Consistency:

- Algorithms execute trades based on precise mathematical models, reducing the chances of errors that can occur due to manual calculations or oversight.

- This consistency helps maintain a disciplined approach to trading, regardless of market conditions.

- Example:

- Emotional trading can lead to impulsive decisions based on fear or greed. Algorithms follow predefined rules, ensuring consistency and objectivity in trading decisions.

Improved Accuracy

Algorithms can analyze vast amounts of data with precision, identifying trading opportunities that may be missed by human traders. This leads to more accurate and informed trading decisions.

- Data-Driven Decisions:

- Algorithms can process and analyze large datasets, including historical price data, news articles, social media sentiment, and economic indicators, to identify patterns and trends.

- This comprehensive analysis enables algorithms to make more informed trading decisions based on a holistic view of the market.

- Machine Learning and AI:

- The integration of machine learning and artificial intelligence allows algorithms to continuously improve their predictive accuracy by learning from new data and adjusting their models.

- Advanced AI techniques such as natural language processing (NLP) enable algorithms to interpret unstructured data and incorporate it into their trading strategies.

- Example:

- Machine learning algorithms can analyze historical price data, news articles, and social media sentiment to predict future price movements with a high degree of accuracy.

Cost-Effectiveness

Algorithmic trading can reduce transaction costs by optimizing trade execution and minimizing market impact. This can lead to significant savings over time.

- Optimized Trade Execution:

- Algorithms can strategically time trades and choose the most cost-effective routes to execute orders, reducing the impact on market prices.

- Techniques such as “iceberging” break large orders into smaller, more manageable chunks, minimizing the risk of significant price changes due to large trades.

- Reduced Transaction Costs:

- By automating the trading process, algorithmic trading reduces the need for manual intervention, lowering the costs associated with human traders, such as salaries and commissions.

- Efficient execution systems ensure that trades are completed at the best possible prices, further reducing transaction costs.

- Example:

- By breaking large orders into smaller trades and executing them over time, algorithms can avoid significant price impact and reduce the overall cost of trading.

Enhanced Market Liquidity

Algorithmic trading contributes to enhanced market liquidity by providing a constant presence of buy and sell orders, making it easier for other market participants to enter and exit positions.

- Liquidity Provision:

- Market-making algorithms place simultaneous buy and sell orders, providing liquidity and narrowing bid-ask spreads. This makes the market more efficient and accessible to all traders.

- Enhanced liquidity ensures that trades can be executed quickly and at stable prices, reducing the risk of slippage.

- Stability and Efficiency:

- The presence of algorithms that continuously trade and update orders helps stabilize the market by smoothing out price fluctuations and absorbing excess volatility.

- This increased stability benefits all market participants by creating a more predictable trading environment.

- Example:

- Market makers, through their algorithmic trading strategies, ensure that there is always a counterparty available for trades, thus enhancing market liquidity and efficiency.

Access to Global Markets

Algorithmic trading allows traders to access and trade in global markets around the clock, leveraging opportunities across different time zones and market conditions.

- 24/7 Trading:

- Algorithms can operate continuously without the need for breaks, enabling traders to capitalize on opportunities in markets that are open outside of regular trading hours.

- This continuous operation ensures that traders can respond to global economic events and news in real-time.

- Diversification:

- Access to multiple markets allows traders to diversify their portfolios, reducing risk and increasing the potential for returns.

- Algorithms can be programmed to trade various asset classes, including equities, forex, commodities, and cryptocurrencies, across different exchanges.

- Example:

- A trading algorithm can be set to monitor and trade in Asian markets during the night and switch to European and American markets during the day, ensuring continuous engagement with global financial opportunities.

Regulatory Compliance

Algorithmic trading systems can be designed to ensure compliance with regulatory requirements, reducing the risk of legal issues and penalties.

- Automated Compliance Checks:

- Algorithms can be programmed to include compliance checks, ensuring that trades adhere to regulatory standards and reporting requirements.

- This automation reduces the risk of non-compliance due to human error or oversight.

- Transparency and Reporting:

- Execution systems can generate detailed reports on trading activities, providing transparency and accountability.

- These reports can be used to demonstrate compliance to regulatory authorities and to conduct internal audits.

- Example:

- An algorithmic trading system can automatically generate and submit transaction reports to regulatory bodies, ensuring timely and accurate compliance with legal requirements.

By leveraging the advantages of speed, efficiency, accuracy, cost-effectiveness, market liquidity, global market access, and regulatory compliance, algorithmic trading provides a robust framework for modern trading practices. These benefits collectively enhance the ability of traders and institutions to achieve their financial objectives while navigating the complexities of global financial markets.

Types of Algorithmic Trading Strategies

Algorithmic trading encompasses various strategies that leverage computational power and data analysis to execute trades based on predefined rules. These strategies can be broadly categorized into trend-following, mean reversion, arbitrage, and market-making strategies.

Trend-Following Strategies

Trend-following strategies aim to capitalize on market trends by buying assets in an uptrend and selling them in a downtrend. These strategies often use moving averages and momentum indicators.

Moving Average Crossover

This strategy involves buying an asset when a short-term moving average crosses above a long-term moving average and selling when the short-term average crosses below the long-term average.

- How It Works:

- Moving averages smooth out price data to identify trends by calculating the average price over a specific period.

- A crossover occurs when the short-term average crosses above or below the long-term average, signaling a change in trend.

- Example:

- A common moving average crossover strategy is the 50-day and 200-day moving average crossover. When the 50-day moving average crosses above the 200-day moving average, it generates a buy signal. When it crosses below, it generates a sell signal.

- Advantages:

- Simple to implement and understand.

- Effective in trending markets.

- Disadvantages:

- May generate false signals in a sideways or choppy market.

- Lagging indicator, meaning it may react slowly to rapid price changes.

Momentum Trading

Momentum trading involves buying assets that have shown upward price movement and selling those that have shown downward movement. It relies on the belief that these trends will continue for some time.

- How It Works:

- Momentum traders look for assets with strong recent performance, expecting the trend to continue.

- Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are commonly used to measure momentum.

- Example:

- A trader might buy a stock that has been increasing in price over the past three months, expecting the upward momentum to continue. Conversely, they might short-sell a stock that has been declining in price.

- Advantages:

- Can capture large price movements.

- Based on observable market behavior.

- Disadvantages:

- Trends can reverse suddenly, leading to losses.

- Requires continuous monitoring of the market.

Mean Reversion Strategies

Mean reversion strategies are based on the idea that asset prices will revert to their historical averages. These strategies involve buying assets when prices are below their average and selling when prices are above.

Bollinger Bands

Bollinger Bands use a moving average and standard deviation to identify overbought and oversold conditions. Traders buy when prices touch the lower band and sell when prices touch the upper band.

- How It Works:

- Bollinger Bands consist of a middle band (a simple moving average) and two outer bands (standard deviations away from the moving average).

- Prices moving towards the outer bands indicate overbought or oversold conditions.

- Example:

- If the price of a stock falls to the lower Bollinger Band, a trader might buy, expecting the price to revert to the mean. If the price rises to the upper band, the trader might sell.

- Advantages:

- Provides a visual representation of volatility and potential reversal points.

- Can be used in combination with other indicators for confirmation.

- Disadvantages:

- Can generate false signals in a strongly trending market.

- Requires constant adjustment of parameters based on market conditions.

RSI-Based Mean Reversion

This strategy uses the Relative Strength Index (RSI) to identify overbought and oversold conditions. Traders buy when the RSI is below a certain threshold and sell when it is above.

- How It Works:

- RSI measures the speed and change of price movements on a scale of 0 to 100.

- An RSI below 30 is often considered oversold, while an RSI above 70 is considered overbought.

- Example:

- An RSI below 30 is often considered oversold, indicating a buying opportunity. An RSI above 70 is considered overbought, indicating a selling opportunity.

- Advantages:

- Simple and widely used indicator.

- Effective in identifying potential reversal points.

- Disadvantages:

- May produce false signals in trending markets.

- Requires confirmation from other indicators to improve accuracy.

Arbitrage Strategies

Arbitrage strategies exploit price discrepancies between different markets or instruments. These strategies involve buying an asset in one market and simultaneously selling it in another at a higher price.

Arbitrage strategies exploit price discrepancies between different markets or instruments. These strategies involve buying an asset in one market and simultaneously selling it in another at a higher price.

Statistical Arbitrage

Statistical arbitrage uses statistical models to identify and exploit price discrepancies between related assets. This strategy involves trading pairs of assets with a high correlation.

- How It Works:

- Statistical models are used to identify deviations from the historical relationship between asset pairs.

- When a deviation is detected, the strategy involves buying the undervalued asset and shorting the overvalued asset, expecting them to revert to their historical correlation.

- Example:

- If two stocks in the same sector historically move together but diverge, a trader might buy the underperforming stock and short the outperforming stock, expecting them to revert to their historical correlation.

- Advantages:

- Can generate profits with minimal market exposure.

- Based on quantitative analysis and statistical methods.

- Disadvantages:

- Requires sophisticated modeling and computational resources.

- Potential for large losses if correlations break down.

Merger Arbitrage

Merger arbitrage involves trading the stocks of companies involved in mergers and acquisitions. Traders buy the stock of the target company and short the stock of the acquiring company to profit from the spread.

- How It Works:

- When a merger or acquisition is announced, the target company’s stock typically rises, while the acquiring company’s stock may fall.

- Merger arbitrageurs buy the target company’s stock and short the acquiring company’s stock, profiting from the difference if the deal goes through.

- Example:

- If Company A announces plans to acquire Company B at a premium, the price of Company B’s stock will rise, while the price of Company A’s stock may fall. A merger arbitrageur would buy Company B’s stock and short Company A’s stock to capture the difference.

- Advantages:

- Potential for predictable returns if the merger or acquisition completes.

- Based on fundamental corporate events.

- Disadvantages:

- Risk of deal failure, which can lead to significant losses.

- Requires detailed analysis of merger terms and regulatory approval processes.

Market Making Strategies

Market making strategies involve providing liquidity to the market by simultaneously placing buy and sell orders. Market makers profit from the bid-ask spread.

High-Frequency Market Making

High-frequency market making uses algorithms to place and adjust orders rapidly, taking advantage of small price changes to earn profits.

- How It Works:

- Algorithms continuously place buy and sell orders at various price levels, profiting from the bid-ask spread.

- Orders are adjusted in real-time based on market conditions and inventory levels.

- Example:

- A market maker might place a buy order at $10.00 and a sell order at $10.05. When the orders are filled, they earn the $0.05 spread. By doing this at high frequency, small profits accumulate quickly.

- Advantages:

- Provides liquidity and stability to the market.

- Generates consistent profits through small spreads.

- Disadvantages:

- Requires significant capital and technological infrastructure.

- Exposed to market risk and adverse selection.

Quote Stuffing

Quote stuffing involves placing a large number of orders to create the illusion of high market activity, then quickly canceling them to manipulate prices.

- How It Works:

- Traders place numerous buy or sell orders at different prices, creating the appearance of strong market interest.

- These orders are canceled almost immediately, influencing other traders’ perceptions and causing them to adjust their positions.

- Example:

- A trader might place thousands of buy orders at various prices, then cancel them immediately to create the appearance of strong buying interest, influencing other traders to buy.

- Advantages:

- Can influence market prices and trading behavior.

- May provide temporary market advantages.

- Disadvantages:

- Considered unethical and is often illegal.

- Attracts regulatory scrutiny and penalties.

By understanding and implementing these various algorithmic trading strategies, traders can leverage the power of algorithms to enhance their trading performance. Each strategy has its unique advantages and disadvantages, and successful traders often use a combination of strategies to navigate different market conditions.

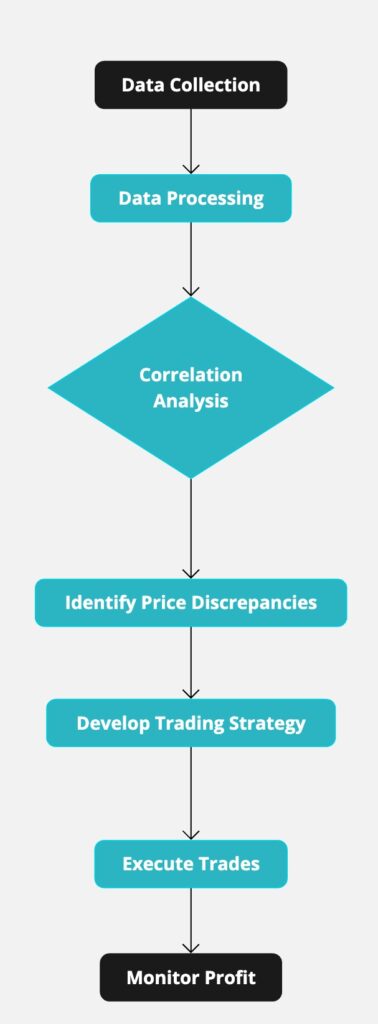

Building an Algorithmic Trading System

Creating an effective algorithmic trading system involves several key steps, from developing trading algorithms to backtesting and optimizing them, and finally, deploying and monitoring the system in live trading. Each of these steps is crucial for ensuring the system’s reliability, efficiency, and profitability.

Developing Trading Algorithms

The development of trading algorithms is the foundation of any algorithmic trading system. It involves designing a set of rules and criteria that dictate trading decisions based on market data analysis.

- Strategy Formulation:

- Defining Objectives: The first step is to define the trading objectives, such as maximizing returns, minimizing risk, or achieving a specific trading frequency.

- Choosing a Strategy: Based on the objectives, select an appropriate trading strategy, such as trend-following, mean reversion, or arbitrage.

- Rule-Based Criteria: Develop a set of rules that the algorithm will follow to identify trading opportunities. These rules are based on technical indicators, statistical models, or fundamental data.

- Algorithm Design:

- Mathematical Models: Use mathematical models to quantify the trading rules. For example, moving averages for trend-following or statistical correlations for arbitrage.

- Programming: Implement the algorithm using a programming language such as Python, R, or C++. Utilize libraries and frameworks that facilitate financial computations and data handling.

- Example:

- A simple moving average crossover strategy involves buying a stock when its short-term moving average (e.g., 50-day) crosses above its long-term moving average (e.g., 200-day) and selling when the short-term average crosses below the long-term average.

Backtesting and Optimization

Backtesting is the process of testing a trading algorithm on historical data to evaluate its performance. Optimization involves fine-tuning the algorithm’s parameters to enhance its effectiveness.

- Backtesting:

- Historical Data: Use historical market data to simulate the algorithm’s performance over a specific period. This helps identify how the algorithm would have performed in past market conditions.

- Performance Metrics: Evaluate the algorithm using performance metrics such as returns, Sharpe ratio, drawdown, and win/loss ratio. This analysis provides insights into the algorithm’s profitability and risk profile.

- Stress Testing: Subject the algorithm to different market scenarios, including high volatility and market crashes, to assess its robustness and stability.

- Optimization:

- Parameter Tuning: Adjust the algorithm’s parameters (e.g., moving average periods, RSI thresholds) to improve its performance. Use techniques like grid search or genetic algorithms to find the optimal parameter settings.

- Out-of-Sample Testing: Test the optimized algorithm on out-of-sample data (data not used in the initial backtesting) to ensure its effectiveness in different market conditions.

- Walk-Forward Analysis: Continuously update and optimize the algorithm based on new data, ensuring it remains adaptive to changing market environments.

- Example:

- In a moving average crossover strategy, backtesting involves simulating the strategy on historical price data to assess its performance. Optimization might involve adjusting the look-back periods for the moving averages to achieve the best results.

Execution and Monitoring

Once the algorithm is developed and optimized, the next step is to deploy it in a live trading environment and continuously monitor its performance.

- Execution:

- Trading Platform: Choose a trading platform that supports algorithmic trading and provides direct market access (DMA) for faster execution. Popular platforms include MetaTrader, TradeStation, and Interactive Brokers.

- Order Types: Implement various order types (e.g., market, limit, stop-loss) to execute trades efficiently and manage risk. Ensure the algorithm can handle different order scenarios and market conditions.

- Connectivity: Ensure the system has reliable connectivity to exchanges and data providers to minimize latency and avoid disruptions.

- Monitoring:

- Real-Time Monitoring: Continuously monitor the algorithm’s performance in real-time, tracking key metrics such as profitability, trade frequency, and execution quality.

- Risk Management: Implement risk management protocols to handle unexpected market events. This includes setting stop-loss limits, position sizing, and diversifying strategies.

- Alerts and Notifications: Set up alerts and notifications for significant events, such as large drawdowns or system errors, to respond promptly and mitigate risks.

- Example:

- An execution system might use the Financial Information Exchange (FIX) protocol to connect to multiple exchanges and execute orders efficiently. Monitoring tools can provide real-time updates on trade performance and system status.

Risk Management

Effective risk management is crucial for the success of an algorithmic trading system. It involves identifying, assessing, and mitigating risks associated with trading activities.

- Position Sizing:

- Capital Allocation: Determine the appropriate amount of capital to allocate to each trade based on the overall portfolio size and risk tolerance. Techniques such as the Kelly Criterion can help optimize position sizing.

- Diversification: Spread investments across different assets, markets, and strategies to reduce risk exposure. This minimizes the impact of adverse price movements in any single asset or market.

- Stop-Loss Orders:

- Setting Limits: Establish stop-loss orders to automatically exit positions that move against the expected direction, limiting potential losses. This ensures that losses do not exceed predefined thresholds.

- Trailing Stops: Use trailing stop orders to lock in profits as the market moves in the favorable direction while still providing protection against reversals.

- Stress Testing:

- Scenario Analysis: Conduct scenario analysis to evaluate the algorithm’s performance under extreme market conditions, such as market crashes or high volatility periods. This helps identify potential vulnerabilities and enhance robustness.

- Value at Risk (VaR): Calculate VaR to estimate the maximum potential loss over a specific period with a given confidence level. This metric aids in understanding and managing the overall risk profile of the trading system.

- Example:

- A risk management protocol might include setting a maximum drawdown limit, beyond which the algorithm will cease trading to prevent further losses. Additionally, regular stress tests can ensure the algorithm remains resilient under different market conditions.

Continuous Improvement and Adaptation

The financial markets are dynamic, and an algorithmic trading system must adapt to changing conditions to remain effective. Continuous improvement involves regular evaluation, adaptation, and enhancement of the trading system.

- Performance Review:

- Regular Analysis: Conduct regular performance reviews to assess the algorithm’s effectiveness and profitability. Analyze key metrics and identify areas for improvement.

- Feedback Loop: Establish a feedback loop where insights from performance reviews inform algorithm adjustments and refinements.

- Adapting to Market Changes:

- Market Conditions: Adapt the algorithm to reflect changing market conditions, such as shifts in volatility, liquidity, and trading volumes. This ensures the algorithm remains responsive and effective.

- Incorporating New Data: Integrate new data sources, such as alternative data and macroeconomic indicators, to enhance the algorithm’s predictive accuracy and decision-making capabilities.

- Research and Development:

- Innovation: Continuously research and develop new strategies and techniques to improve the trading system. Stay updated with advancements in technology, machine learning, and financial modeling.

- Collaborative Efforts: Collaborate with other traders, developers, and researchers to exchange ideas and leverage collective expertise.

- Example:

- Regular performance reviews might reveal that a previously effective trend-following strategy is underperforming in current market conditions. In response, the algorithm could be adapted to incorporate additional indicators or adjust its parameters to better align with the new market environment.

By systematically developing, backtesting, optimizing, executing, and continuously improving an algorithmic trading system, traders can enhance their ability to achieve consistent and profitable trading outcomes. Each component plays a crucial role in ensuring the system’s robustness, adaptability, and long-term success.

Advanced Algorithmic Trading Strategies

Strategies to take investments to a new level

Machine Learning and AI in Trading

Machine learning (ML) and artificial intelligence (AI) have transformed algorithmic trading by enabling algorithms to learn from data, identify complex patterns, and make predictive decisions. These technologies can process vast amounts of data quickly and accurately, improving the effectiveness of trading strategies.

Predictive Analytics

Predictive analytics involves using machine learning models to forecast future price movements based on historical data. These models can identify patterns and trends that are not easily observable by human traders, providing a significant advantage in predicting market behavior.

- Techniques:

- Regression Analysis: Regression models, such as linear regression or logistic regression, can predict the future price of an asset based on historical data. These models establish relationships between the price and other variables, such as volume and volatility.

- Neural Networks: Neural networks, including deep learning models, can capture complex, non-linear relationships in data. These models can learn from vast datasets, improving their predictive accuracy over time.

- Implementation:

- Data Collection: Gather historical price data, trading volumes, and other relevant indicators.

- Feature Engineering: Transform raw data into meaningful features that can be used by the model. This may include technical indicators, moving averages, and sentiment scores.

- Model Training: Train the machine learning model on historical data, validating its performance using techniques like cross-validation.

- Prediction: Use the trained model to predict future price movements and generate buy and sell signals.

- Example:

- A machine learning model might analyze historical price data and identify patterns that predict future price movements. For instance, the model could predict a price increase based on historical trends and generate a buy signal.

- Advantages:

- Accuracy: ML models can process and analyze vast amounts of data with high precision.

- Adaptability: Models can continuously learn and adapt to new data, improving their predictions over time.

- Disadvantages:

- Complexity: Building and maintaining ML models requires significant expertise and computational resources.

- Overfitting: Models can sometimes become too tailored to historical data, reducing their effectiveness in real-time trading.

Natural Language Processing

Natural language processing (NLP) involves analyzing textual data, such as news articles, social media posts, and financial reports, to gauge market sentiment and predict price movements. NLP algorithms can interpret and quantify the sentiment expressed in text, providing valuable insights for trading decisions.

- Techniques:

- Sentiment Analysis: NLP models analyze text to determine whether the sentiment is positive, negative, or neutral. This can be applied to news articles, earnings reports, and social media posts.

- Topic Modeling: Identifying topics and themes in large text datasets to understand market trends and investor sentiment.

- Implementation:

- Data Collection: Gather textual data from various sources, including news websites, social media platforms, and financial reports.

- Text Processing: Clean and preprocess the text data, removing stop words, normalizing text, and extracting relevant features.

- Sentiment Scoring: Use NLP models to assign sentiment scores to the text, quantifying the overall market sentiment.

- Integration: Incorporate sentiment scores into trading algorithms to inform buy and sell decisions.

- Example:

- An NLP algorithm might analyze tweets about a company to gauge public sentiment. If the sentiment is overwhelmingly positive, the algorithm might generate a buy signal, expecting the company’s stock price to rise.

- Advantages:

- Real-Time Analysis: NLP can provide real-time insights into market sentiment, allowing traders to respond quickly to news and events.

- Comprehensive Data: NLP can analyze a wide range of textual data sources, providing a more holistic view of market conditions.

- Disadvantages:

- Data Quality: The accuracy of NLP models depends on the quality and relevance of the text data.

- Interpretation: Sentiment analysis can be challenging to interpret, as it may not always directly correlate with price movements.

High-Frequency Trading (HFT)

High-frequency trading (HFT) involves executing a large number of trades at extremely high speeds, often within milliseconds. HFT strategies exploit small price discrepancies across different markets, capitalizing on the rapid execution of trades to generate profits.

Latency Arbitrage

Latency arbitrage involves exploiting delays in the dissemination of market information to execute trades before other market participants. HFT firms gain a competitive advantage by reducing the time it takes to receive and act on market data.

- Techniques:

- Co-Location: Placing trading servers close to exchange servers to minimize latency and gain faster access to market data.

- Ultra-Low Latency Networks: Using high-speed networks and advanced hardware to achieve the lowest possible latency.

- Implementation:

- Data Synchronization: Ensure that the trading system receives and processes market data in real-time.

- Algorithm Design: Develop algorithms that can quickly identify and act on price discrepancies, executing trades within milliseconds.

- Infrastructure: Invest in high-performance computing infrastructure and co-location services to achieve minimal latency.

- Example:

- A trader might use co-location services to place their servers near exchange servers, reducing latency and gaining a speed advantage in executing trades based on new information.

- Advantages:

- Speed: HFT firms can execute trades faster than other market participants, capturing fleeting opportunities.

- Profitability: Small price discrepancies can lead to substantial cumulative profits due to the high volume of trades.

- Disadvantages:

- Infrastructure Costs: HFT requires significant investment in technology and infrastructure.

- Regulatory Risks: HFT is subject to regulatory scrutiny, with potential risks related to market manipulation and fairness.

Co-Location

Co-location involves placing trading servers in close proximity to exchange servers to reduce latency and gain a speed advantage. This practice is essential for HFT firms that rely on rapid trade execution.

- Techniques:

- Data Center Proximity: Locating servers within the same data centers as exchange servers to achieve the lowest possible latency.

- Optimized Routing: Using the most efficient network routes to transmit data between trading systems and exchanges.

- Implementation:

- Service Agreements: Establish agreements with data center providers to secure co-location services.

- Hardware Optimization: Deploy high-performance servers and network equipment to maximize speed and reliability.

- Latency Monitoring: Continuously monitor and optimize network latency to maintain competitive advantage.

- Example:

- High-frequency traders often pay a premium to place their servers in data centers near major exchanges, allowing them to receive and act on market data faster than competitors.

- Advantages:

- Competitive Edge: Co-location provides a significant speed advantage, allowing traders to execute trades faster than others.

- Improved Execution: Reduced latency leads to better trade execution and higher profitability.

- Disadvantages:

- Cost: Co-location services can be expensive, requiring ongoing investment in infrastructure and maintenance.

- Access Inequality: Smaller traders may not have the resources to afford co-location, leading to unequal access to trading opportunities.

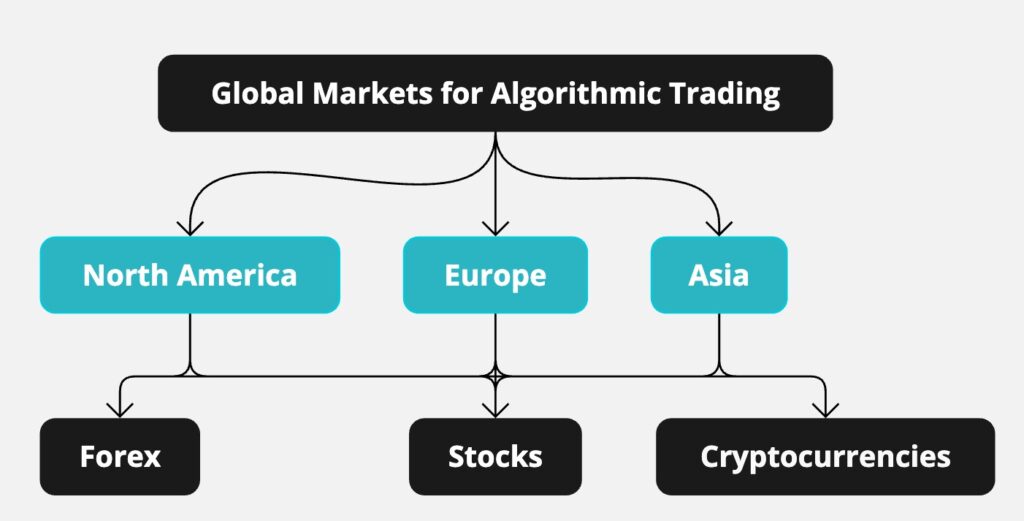

Algorithmic Trading in Different Markets

Algorithmic trading strategies can be applied across various financial markets, including forex, stocks, and cryptocurrencies. Each market has unique characteristics and opportunities, requiring tailored strategies to optimize performance.

Forex Trading

Algorithmic trading in the forex market involves using algorithms to trade currency pairs. Strategies can include trend-following, mean reversion, and arbitrage, tailored to the highly liquid and volatile nature of the forex market.

- Techniques:

- Trend-Following: Identifying and capitalizing on trends in currency pairs, such as the EUR/USD or GBP/USD.

- Mean Reversion: Exploiting deviations from historical price levels, expecting prices to revert to the mean.

- Arbitrage: Taking advantage of price discrepancies between different forex markets or currency pairs.

- Implementation:

- Data Analysis: Collect and analyze historical and real-time data on currency pairs to identify trading opportunities.

- Algorithm Design: Develop algorithms that can adapt to the fast-moving and highly liquid forex market.

- Risk Management: Implement risk management techniques, such as stop-loss orders and position sizing, to manage the high volatility in forex trading.

- Example:

- A trader might use a trend-following algorithm to trade the EUR/USD pair, buying when the pair is in an uptrend and selling when it is in a downtrend.

- Advantages:

- Liquidity: The forex market is highly liquid, allowing for large trades with minimal impact on prices.

- 24/7 Trading: Forex markets operate 24 hours a day, providing continuous trading opportunities.

- Disadvantages:

- Volatility: High volatility can lead to significant price swings, increasing the risk of losses.

- Leverage: The use of leverage in forex trading can amplify both gains and losses, requiring careful risk management

Stock Trading

In the stock market, algorithmic trading can involve various strategies, including market making, statistical arbitrage, and momentum trading. These strategies are designed to capitalize on price movements and market inefficiencies.

- Techniques:

- Market Making: Providing liquidity by placing simultaneous buy and sell orders, profiting from the bid-ask spread.

- Statistical Arbitrage: Trading pairs of stocks with historical correlations, exploiting deviations from the norm.

- Momentum Trading: Identifying and trading stocks that exhibit strong momentum, expecting the trend to continue.

- Implementation:

- Data Collection: Gather historical price data, trading volumes, and other relevant indicators for stocks.

- Algorithm Development: Design and implement algorithms that can efficiently trade stocks based on the chosen strategy.

- Backtesting: Test the algorithms on historical stock data to evaluate performance and optimize parameters.

- Example:

- A statistical arbitrage algorithm might trade pairs of stocks in the same sector, buying the underperforming stock and shorting the outperforming stock to capture the spread.

- Advantages:

- Diverse Strategies: The stock market offers a wide range of strategies, from value investing to growth investing.

- Data Availability: Extensive historical data is available for backtesting and strategy development.

- Disadvantages:

- Market Impact: Large trades can impact stock prices, requiring careful execution to minimize slippage.

- Regulation: Stock markets are heavily regulated, with strict compliance requirements.

Cryptocurrency Trading

Algorithmic trading in the cryptocurrency market is gaining popularity due to the market’s high volatility and 24/7 trading environment. Strategies can include arbitrage, market making, and trend-following, adapted to the unique characteristics of digital assets.

- Techniques:

- Arbitrage: Exploiting price discrepancies between different cryptocurrency exchanges, buying on one exchange and selling on another.

- Market Making: Providing liquidity to cryptocurrency markets by placing buy and sell orders, profiting from the bid-ask spread.

- Trend-Following: Identifying and trading on trends in cryptocurrency prices, such as Bitcoin or Ethereum.

- Implementation:

- Exchange Connectivity: Establish connections to multiple cryptocurrency exchanges to access real-time market data and execute trades.

- Algorithm Development: Develop algorithms that can handle the high volatility and unique market dynamics of cryptocurrencies.

- Security Measures: Implement robust security measures to protect against hacking and fraud in the cryptocurrency market.

- Example:

- A trader might use an arbitrage algorithm to exploit price discrepancies between different cryptocurrency exchanges, buying on one exchange and selling on another.

- Advantages:

- Volatility: High volatility provides numerous trading opportunities.

- 24/7 Market: Cryptocurrency markets operate continuously, allowing for around-the-clock trading.

- Disadvantages:

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving, with potential risks related to legal compliance.

- Security Risks: Cryptocurrencies are vulnerable to hacking and fraud, requiring robust security measures.

By leveraging advanced algorithmic trading strategies, traders can enhance their ability to navigate different financial markets and capitalize on opportunities. These strategies, powered by machine learning, AI, and high-frequency trading techniques, offer significant potential for improving trading performance and achieving consistent profitability

Legal and Ethical Considerations in Algorithmic Trading

Legal and Ethical things to have in mind

Regulatory Environment

The regulatory environment for algorithmic trading is designed to ensure fair, efficient, and transparent markets. Regulatory bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in the United States, as well as the European Securities and Markets Authority (ESMA) in the European Union, set rules and guidelines that algorithmic traders must follow.

Compliance with Regulations

Compliance with regulations involves adhering to rules that govern market behavior, trading practices, and data reporting. Algorithmic traders must stay informed about current regulations and ensure their trading activities align with legal requirements.

- Key Regulations:

- SEC Regulations: The SEC’s Regulation NMS (National Market System) mandates fair and efficient access to market data, which impacts how algorithmic traders operate. This regulation aims to improve the transparency and fairness of trading activities.

- CFTC Regulations: The CFTC oversees futures and derivatives markets, setting rules that algorithmic traders must follow to ensure market integrity and protect against manipulation.

- MiFID II: The European Union’s Markets in Financial Instruments Directive (MiFID II) requires detailed reporting and transparency in trading activities, impacting how algorithmic strategies are developed and executed.

- Implementation:

- Regular Audits: Conduct regular internal audits to ensure compliance with regulatory requirements. This includes reviewing trading algorithms, execution practices, and data reporting protocols.

- Compliance Officers: Employ compliance officers to oversee regulatory adherence and communicate with regulatory bodies. They ensure that all trading activities meet legal standards.

- Example:

- The SEC’s Regulation NMS mandates that market data be accessible fairly and efficiently, impacting how algorithmic traders can access and use this data. Traders must ensure their algorithms comply with these data access rules.

- Advantages:

- Market Integrity: Compliance with regulations helps maintain the integrity and stability of financial markets.

- Avoiding Penalties: Adhering to regulatory standards reduces the risk of legal penalties and fines.

- Disadvantages:

- Operational Costs: Compliance can increase operational costs due to the need for regular audits and compliance officers.

- Complexity: Navigating the regulatory landscape can be complex, requiring continuous monitoring and adaptation.

Reporting Requirements

Reporting requirements mandate that algorithmic traders provide detailed information about their trading activities to regulatory authorities. This transparency helps regulators monitor market behavior and ensure compliance with legal standards.

- Required Reports:

- Trade Data: Traders must report detailed trade data, including the algorithms used, trade execution times, and volumes.

- Algorithmic Details: Information about the algorithms, including their design, logic, and performance metrics, must be disclosed to regulators.

- Execution Practices: Details on how trades are executed, including any use of high-frequency trading techniques or co-location services.

- Implementation:

- Automated Reporting Systems: Develop automated systems to generate and submit required reports to regulatory bodies. These systems ensure accurate and timely reporting.

- Documentation: Maintain comprehensive documentation of all trading algorithms and strategies, including changes and updates.

- Example:

- Under the European Union’s Markets in Financial Instruments Directive (MiFID II), traders must report detailed information about their algorithmic trading strategies and execution practices. This includes the logic behind the algorithms and their performance.

- Advantages:

- Transparency: Reporting enhances transparency in the market, helping to identify and prevent manipulative practices.

- Regulatory Compliance: Meeting reporting requirements ensures compliance with legal standards, reducing the risk of penalties.

- Disadvantages:

- Administrative Burden: The reporting process can be time-consuming and require significant administrative resources.

- Data Security: Detailed reports can expose sensitive information about trading strategies, requiring robust data security measures.

Ethical Issues

Algorithmic trading raises several ethical issues, particularly concerning market manipulation and fairness. Traders must ensure their algorithms operate ethically and do not engage in practices that could harm market integrity or disadvantage other participants.

Market Manipulation (H4)

Market manipulation involves using deceptive practices to influence market prices or create misleading appearances of supply and demand. Algorithmic traders must avoid engaging in manipulative activities and ensure their algorithms operate transparently and fairly.

- Types of Manipulation:

- Spoofing: Placing fake orders to create the illusion of demand or supply, then canceling them before execution. This practice misleads other traders about market conditions.

- Layering: Similar to spoofing, layering involves placing multiple orders at different price levels to manipulate the market, then canceling them to create false impressions of market depth.

- Detection and Prevention:

- Algorithmic Audits: Regularly audit trading algorithms to ensure they do not engage in manipulative practices. This involves reviewing order placement and cancellation patterns.

- Compliance Monitoring: Implement real-time monitoring systems to detect and prevent manipulative activities. These systems can flag suspicious trading behaviors for further investigation.

- Example:

- Spoofing involves placing fake orders to create the illusion of demand, then canceling them before they are executed. This practice is illegal and unethical, as it misleads other market participants.

- Advantages:

- Market Fairness: Preventing manipulation helps maintain a fair and transparent market environment.

- Reputation: Ethical trading practices enhance the reputation and credibility of trading firms.

- Disadvantages:

- Complex Monitoring: Detecting and preventing manipulation requires sophisticated monitoring systems and ongoing vigilance.

- Regulatory Scrutiny: Firms that fail to prevent manipulation can face increased regulatory scrutiny and penalties.

Fairness and Transparency

Ensuring fairness and transparency in algorithmic trading is crucial for maintaining market integrity. Traders should avoid practices that give them an unfair advantage over other market participants and ensure their activities are transparent.

- Fair Trading Practices:

- Equal Access: Ensure that all market participants have equal access to market data and trading opportunities. Avoid using proprietary information or technologies that provide an unfair advantage.

- Order Transparency: Maintain transparency in order placement and execution. Avoid practices that obscure true market conditions or mislead other traders.

- Ethical Guidelines:

- Code of Conduct: Develop and enforce a code of conduct that outlines ethical trading practices and prohibits manipulative behaviors.

- Training: Provide regular training for traders and developers on ethical trading practices and regulatory compliance.

- Example:

- High-frequency trading firms must ensure their activities do not unfairly disadvantage other traders by manipulating market prices or exploiting information asymmetry. This includes avoiding practices like front-running or using privileged access to market data.

- Advantages:

- Market Trust: Fair and transparent trading practices build trust among market participants and regulators.

- Sustainability: Ethical practices contribute to the long-term sustainability and stability of financial markets.

- Disadvantages:

- Competitive Pressure: Ensuring fairness may limit certain competitive advantages, requiring firms to innovate within ethical boundaries.

- Implementation Costs: Establishing and maintaining systems for ensuring fairness and transparency can be resource-intensive.

By adhering to legal and ethical considerations, algorithmic traders can contribute to the integrity and stability of financial markets. Compliance with regulations, preventing market manipulation, and ensuring fairness and transparency are essential components of responsible algorithmic trading. These practices not only protect traders from legal penalties but also promote a fair and equitable trading environment for all market participants.

Future Trends in Algorithmic Trading

Learn about what is coming up in Algo Trading

Advances in Technology

Technological advancements are at the forefront of the evolution in algorithmic trading. Emerging technologies like quantum computing and blockchain are set to revolutionize trading strategies and operations.

Quantum Computing

Quantum computing has the potential to revolutionize algorithmic trading by processing vast amounts of data at unprecedented speeds. This could lead to more accurate and efficient trading algorithms.

- Potential Impact:

- Data Processing: Quantum computing can handle and process vast datasets much faster than classical computers, enabling real-time analysis and decision-making.

- Complex Optimization: Quantum algorithms can solve complex optimization problems, such as portfolio optimization and risk management, more efficiently.

- Applications:

- Algorithm Development: Quantum algorithms can enhance the development of trading strategies by optimizing parameters and identifying patterns in large datasets.

- Risk Management: Quantum computing can improve risk assessment and management by analyzing multiple risk factors simultaneously and more accurately.

- Example:

- Quantum algorithms could solve complex optimization problems much faster than classical computers, leading to more effective trading strategies. For instance, optimizing a large portfolio to maximize returns while minimizing risk could be achieved in a fraction of the time required by classical algorithms.

- Advantages:

- Speed: Quantum computing offers significantly faster data processing capabilities.

- Efficiency: More efficient problem-solving for complex optimization tasks.

- Disadvantages:

- Accessibility: Quantum computing technology is still in its early stages and not widely accessible.

- Cost: The development and maintenance of quantum computers are expensive.

Blockchain Technology

Blockchain technology can enhance the transparency and security of algorithmic trading. It provides a decentralized, immutable ledger for recording transactions, ensuring data integrity and reducing the risk of fraud.

- Potential Impact:

- Transparency: Blockchain ensures that all transactions are recorded transparently and can be verified by all parties involved.

- Security: The decentralized nature of blockchain makes it resistant to hacking and fraud, enhancing the security of trading operations.

- Applications:

- Smart Contracts: Smart contracts on blockchain platforms can automate and enforce trading rules, reducing the need for intermediaries and minimizing the risk of human error.

- Data Integrity: Blockchain can be used to verify the authenticity and integrity of trading data, ensuring that it has not been tampered with.

- Example:

- Smart contracts on blockchain platforms could automate and enforce trading rules, reducing the risk of fraud and enhancing trust in the trading process. For instance, a smart contract could automatically execute a trade when certain conditions are met, ensuring compliance with pre-defined rules.

- Advantages:

- Transparency: All transactions are recorded in an immutable ledger.

- Security: Enhanced protection against fraud and cyber-attacks.

- Disadvantages:

- Scalability: Blockchain technology currently faces scalability issues, which can limit its application in high-frequency trading.

- Regulatory Uncertainty: The regulatory environment for blockchain technology is still evolving.

Increasing Adoption

Algorithmic trading is becoming increasingly accessible and attractive to both retail and institutional traders. The democratization of trading tools and the continuous investment in advanced technologies are driving this trend.

Retail Traders

Algorithmic trading is becoming more accessible to retail traders through user-friendly platforms and tools. This democratization of algo trading is expected to continue, enabling more individuals to leverage sophisticated trading strategies.

- Platforms and Tools:

- QuantConnect: An open-source platform that provides tools for developing, backtesting, and deploying trading algorithms.

- Alpaca: A commission-free trading platform that offers API access for algorithmic trading, making it easier for retail traders to implement their strategies.

- Educational Resources:

- Online Courses: Numerous online courses and tutorials are available to help retail traders learn the fundamentals of algorithmic trading and develop their skills.

- Community Support: Online communities and forums provide support and knowledge sharing among retail traders.

- Example:

- Platforms like QuantConnect and Alpaca provide retail traders with the tools to develop, backtest, and deploy their own trading algorithms. For example, a retail trader can use QuantConnect to create a trend-following strategy and test its performance on historical data.

- Advantages:

- Accessibility: More individuals can access sophisticated trading tools and strategies.

- Education: Increased availability of educational resources empowers retail traders.

- Disadvantages:

- Risk Exposure: Retail traders may face higher risks if they lack the necessary knowledge and experience.

- Capital Requirements: Algorithmic trading may require substantial initial capital investment.

Institutional Traders

Institutional traders are increasingly adopting algorithmic trading to gain a competitive edge. The use of advanced strategies and technologies is expected to grow, driven by the need for efficiency, accuracy, and scalability.

- Advanced Strategies:

- AI and Machine Learning: Institutions are investing heavily in AI and machine learning to develop sophisticated trading algorithms that can process large datasets and make predictive decisions.

- High-Frequency Trading: Many institutions are leveraging high-frequency trading strategies to exploit small price discrepancies and generate profits.

- Infrastructure Investment:

- Co-Location Services: Institutions often invest in co-location services to reduce latency and gain a speed advantage in trade execution.

- High-Performance Computing: Advanced computing infrastructure is essential for running complex algorithms and processing vast amounts of data in real-time.

- Example:

- Hedge funds and investment banks are investing heavily in artificial intelligence and machine learning to develop more sophisticated trading algorithms. For instance, a hedge fund might use machine learning models to analyze market sentiment and predict price movements, gaining a competitive edge.

- Advantages:

- Efficiency: Advanced algorithms can process and analyze data faster, leading to more efficient trading.

- Competitive Edge: Institutions can gain a significant advantage through the use of cutting-edge technologies and strategies.

- Disadvantages:

- High Costs: Significant investment is required in technology and infrastructure.

- Regulatory Challenges: Institutions must navigate complex regulatory environments, ensuring compliance with various rules and guidelines.

Impact on Market Dynamics

The adoption of advanced algorithmic trading strategies and technologies is reshaping market dynamics. These changes are influencing market liquidity, volatility, and the overall structure of financial markets.

- Market Liquidity:

- Increased Liquidity: Algorithmic trading often provides liquidity to the market by placing a large number of buy and sell orders. This increased liquidity can make it easier for other market participants to execute their trades.

- Market Making: High-frequency trading firms often act as market makers, contributing to the depth and stability of the market.

- Market Volatility:

- Reduced Volatility: In some cases, algorithmic trading can reduce market volatility by smoothing out price fluctuations through continuous trading and liquidity provision.

- Increased Volatility: Conversely, during periods of market stress, algorithmic trading can exacerbate volatility if algorithms react to the same signals simultaneously, leading to rapid price changes.

- Market Structure:

- Fragmentation: The rise of algorithmic trading has led to market fragmentation, with trades being executed across multiple exchanges and platforms. This can create challenges in terms of price discovery and market transparency.

- Consolidation: Some markets may see consolidation as larger firms leverage their technological advantages to dominate trading volumes and market share.

- Example:

- The impact of algorithmic trading on market dynamics was evident during the “Flash Crash” of May 6, 2010, when the U.S. stock market experienced a sudden and severe drop in prices, followed by a rapid recovery. Algorithmic trading was implicated in exacerbating the crash, highlighting the need for robust risk management and regulatory oversight.

- Advantages:

- Liquidity: Enhanced market liquidity benefits all participants by providing more opportunities to trade.

- Efficiency: Improved market efficiency through faster trade execution and better price discovery.

- Disadvantages:

- Volatility: Potential for increased volatility and market disruptions during periods of stress.

- Complexity: The complexity of the market structure can create challenges for regulators and market participants.

By staying abreast of these future trends, traders and institutions can better navigate the evolving landscape of algorithmic trading. Advances in technology, increasing adoption, and the impact on market dynamics will continue to shape the future of trading, offering both opportunities and challenges.

Case Studies in Algorithmic Trading

Algorithmic Case Studies

Topaz Global’s Algorithmic Trading Journey

Topaz Global, a firm specializing in algorithmic trading, has leveraged advanced trading strategies and technologies to enhance its performance in the financial markets. By integrating cutting-edge algorithms, risk management practices, and continuous improvement processes, Topaz Global has achieved significant success.

- Strategy and Techniques:

- Data-Driven Decision Making: Topaz Global employs sophisticated data analysis techniques to develop and refine its trading algorithms. The firm uses machine learning models to analyze historical price data, news articles, and social media sentiment, generating accurate and timely trading signals.

- Diverse Trading Strategies: The firm utilizes a range of algorithmic trading strategies, including trend-following, mean reversion, and statistical arbitrage, to capitalize on different market conditions. This diversified approach helps mitigate risks and enhance overall performance.

- High-Frequency Trading (HFT): Topaz Global engages in high-frequency trading to exploit short-term market inefficiencies. By utilizing co-location services and high-speed networks, the firm can execute trades within milliseconds, capturing small price discrepancies across different markets.

- Achievements:

- Consistent Performance: Topaz Global has consistently delivered strong returns to its investors by leveraging advanced algorithmic trading strategies. The firm’s data-driven approach and continuous refinement of algorithms have contributed to its success.

- Technological Innovation: Topaz Global has invested heavily in technology and infrastructure, ensuring its trading systems remain at the forefront of the industry. This investment has enabled the firm to maintain a competitive edge in the fast-paced world of algorithmic trading.

- Challenges:

- Regulatory Compliance: Navigating the complex regulatory environment is a continuous challenge for Topaz Global. The firm must ensure that its trading activities comply with various rules and guidelines set by regulatory bodies such as the SEC and CFTC.

- Market Competition: The competitive nature of algorithmic trading requires Topaz Global to continuously innovate and improve its strategies. Staying ahead of other market participants necessitates ongoing investment in research and development.

- Key Takeaways:

- Data Integration: The integration of diverse data sources, including historical market data and alternative data such as social media sentiment, is crucial for developing effective trading algorithms.

- Continuous Improvement: Regular performance reviews and algorithm optimization are essential for maintaining and enhancing trading effectiveness in a dynamic market environment.

Risk Management at Topaz Global

Risk management is a critical component of Topaz Global’s algorithmic trading operations. The firm employs a comprehensive risk management framework to protect against potential losses and ensure long-term stability.

- Position Sizing:

- Capital Allocation: Topaz Global determines the appropriate amount of capital to allocate to each trade based on the overall portfolio size and risk tolerance. This approach helps manage exposure and minimize potential losses.

- Diversification: The firm diversifies its investments across different assets, markets, and strategies to reduce risk. This strategy helps mitigate the impact of adverse price movements in any single asset or market.

- Stop-Loss Orders: